Dear Channel Partner, Welcome to the Anupaat Nivesh family! We’re thrilled to have you join us as a valued channel partner. At Anupaat Nivesh, our mission is to empower individuals and families with informed and accessible financial solutions, helping them achieve their financial dreams. As a channel partner, you now play a crucial role in delivering these solutions to clients and in expanding our reach to new communities. Our flagship products, including FIDOK (Financial Information and Documents Organizer Kit) and the Risk Profile Analysis Tools, are designed to simplify and enhance the investment experience for investors. What you can expect as a partner: Access to a comprehensive suite of high-quality products that address diverse financial needs. Ongoing training, sales tools, and support to ensure you have everything needed for success. Attractive incentives and a collaborative environment focused on growth and development. Your journey with us begins now, and we’re here to support you every step of the way. If you have any questions or need assistance, please don’t hesitate to reach out to us at Phone Number:- 9501195200 Email Address:- Contact@anupaatnivesh.com Thank you for your commitment to excellence, and welcome to a partnership focused on shared success and impactful financial growth. Warm regards, Team Anpaat Nivesh

Anupaat Nivesh Founded in 2018, Anupaat Nivesh emerged from a vision to make financial literacy and investment opportunities accessible to everyone. Our journey began with a small team of passionate finance professionals dedicated to guiding individuals and families toward informed financial decisions. Over the years, we have grown into a trusted name in the personal finance sector, providing a comprehensive range of services, including mutual funds, equity investment, and insurance solutions. Our Mission At Anupaat Nivesh, our mission is to empower individuals and families with informed and accessible financial solutions. We strive to provide our clients with the knowledge, tools, and resources they need to make sound financial decisions and achieve their financial dreams. Our Vision We envision a future where everyone has the ability to manage their finances effectively and confidently, leading to enhanced financial security and prosperity. Our goal is to be the go-to partner for all financial needs, recognized for our integrity, expertise, and client-centric approach. Our Values Integrity: We believe in maintaining the highest standards of honesty and transparency in all our dealings. Customer-Centricity: Our clients are at the heart of everything we do. We prioritize their needs and work to exceed their expectations. Innovation: We embrace change and continuously seek new ways to enhance our services and deliver value. Collaboration: We foster a culture of teamwork and collaboration, both within our organization and with our partners. Excellence: We are committed to delivering exceptional quality in our products and services. The Importance of Channel Partners Channel partners play a pivotal role in the growth and success of Anupaat Nivesh. They act as the bridge between our innovative products and the clients who need them, facilitating access to our services in diverse communities. By leveraging their local knowledge and relationships, channel partners help us expand our reach and enhance customer engagement. As a vital part of our business model, channel partners are empowered with the training, resources, and support necessary to educate clients about our offerings and assist them in making informed investment decisions. Their success directly contributes to our collective mission of promoting financial literacy and security, making them indispensable to our journey.

Mutual Funds Overview: Mutual funds are professionally managed investment schemes that pool money from multiple investors to purchase securities such as stocks, bonds, or other assets. Key Features: Diversification: Invest in a wide range of assets to spread risk. Professional Management: Managed by experienced fund managers who make investment decisions based on market analysis. Liquidity: Easy to buy and sell, providing flexibility for investors. Benefits: Accessibility: Minimum investment amounts are relatively low, making it easy for anyone to start investing. Variety: A wide range of funds available, catering to different risk profiles and investment goals. Tax Benefits: Certain mutual funds, such as ELSS (Equity Linked Savings Scheme), offer tax deductions under Section 80C. Target Audience: New investors looking for a beginner-friendly investment option. Individuals seeking long-term wealth creation. Investors who prefer professional management of their portfolios.

Overview: Anupaat Nivesh offers a convenient way to access funds without liquidating your mutual fund investments. Key Features: Quick Disbursal: Receive funds quickly to meet urgent financial needs. Flexible Repayment: Choose repayment terms that suit your financial situation. Minimal Documentation: A hassle-free process with minimal paperwork. Benefits: Preserve Investments: Maintain your long-term investment goals. Leverage Your Assets: Utilize the value of your mutual fund holdings. Competitive Interest Rates: Enjoy attractive interest rates on your loan. Target Audience: Investors who need immediate liquidity without selling their investments. Individuals seeking a secured loan option.

Overview: Anupaat Nivesh offers a comprehensive suite of insurance solutions designed to protect individuals and families from financial uncertainties. Key Features: Term Insurance: Provides life coverage for a specified period, ensuring financial security for beneficiaries. Health Insurance: Covers medical expenses for hospitalization, surgeries, and treatments. Motor Insurance: Protects against losses related to vehicle damage, theft, or liability. Benefits: Financial Protection: Safeguard loved ones and assets against unexpected events. Peace of Mind: Knowing that financial risks are mitigated helps reduce stress. Customizable Plans: Tailored coverage options to fit individual needs and budgets. Target Audience: Individuals looking to secure their family’s financial future. Young professionals seeking affordable health and life coverage. Vehicle owners needing protection against accidents and liabilities.

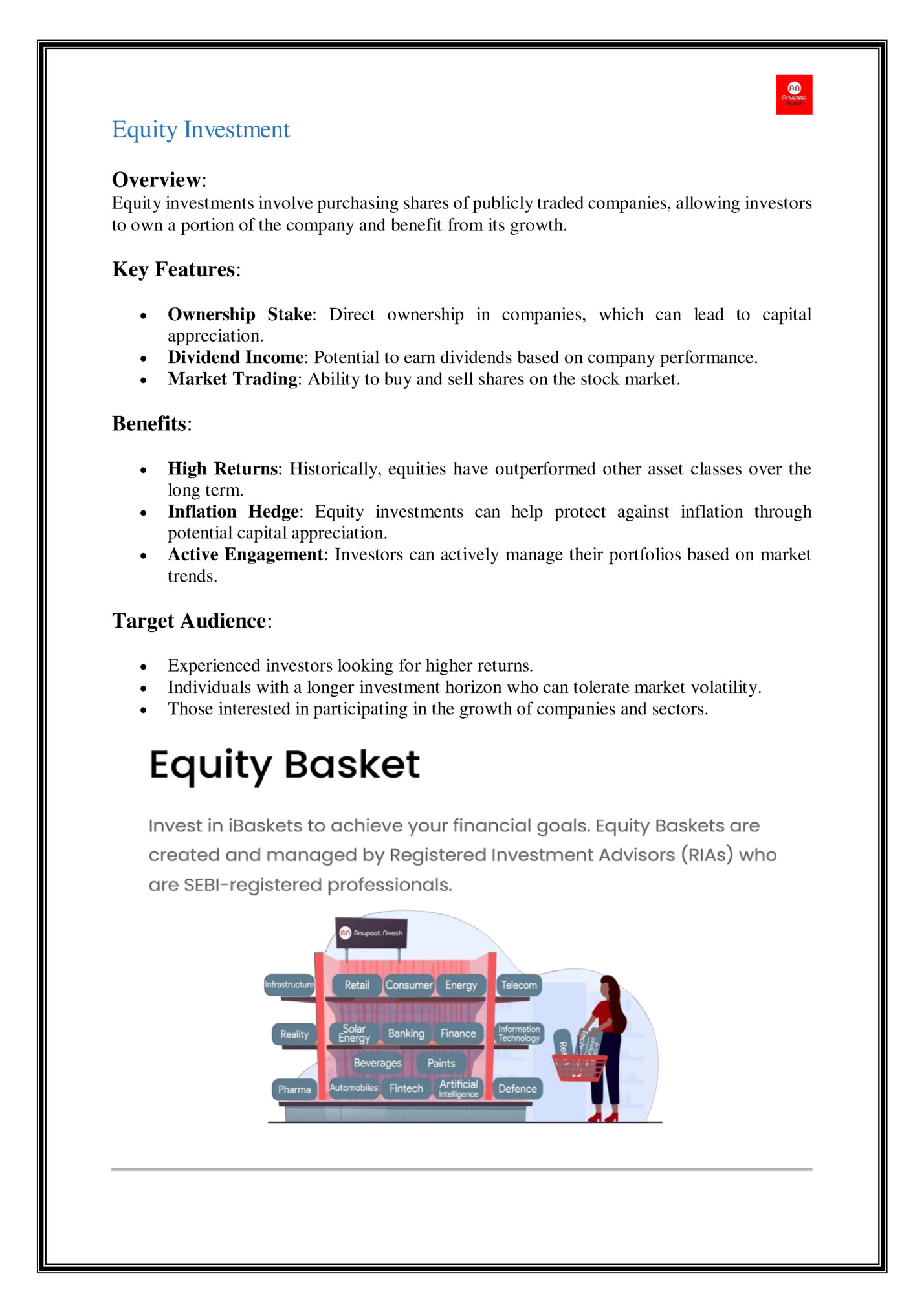

Overview: Equity investments involve purchasing shares of publicly traded companies, allowing investors to own a portion of the company and benefit from its growth. Key Features: Ownership Stake: Direct ownership in companies, which can lead to capital appreciation. Dividend Income: Potential to earn dividends based on company performance. Market Trading: Ability to buy and sell shares on the stock market. Benefits: High Returns: Historically, equities have outperformed other asset classes over the long term. Inflation Hedge: Equity investments can help protect against inflation through potential capital appreciation. Active Engagement: Investors can actively manage their portfolios based on market trends. Target Audience: Experienced investors looking for higher returns. Individuals with a longer investment horizon who can tolerate market volatility. Those interested in participating in the growth of companies and sectors.

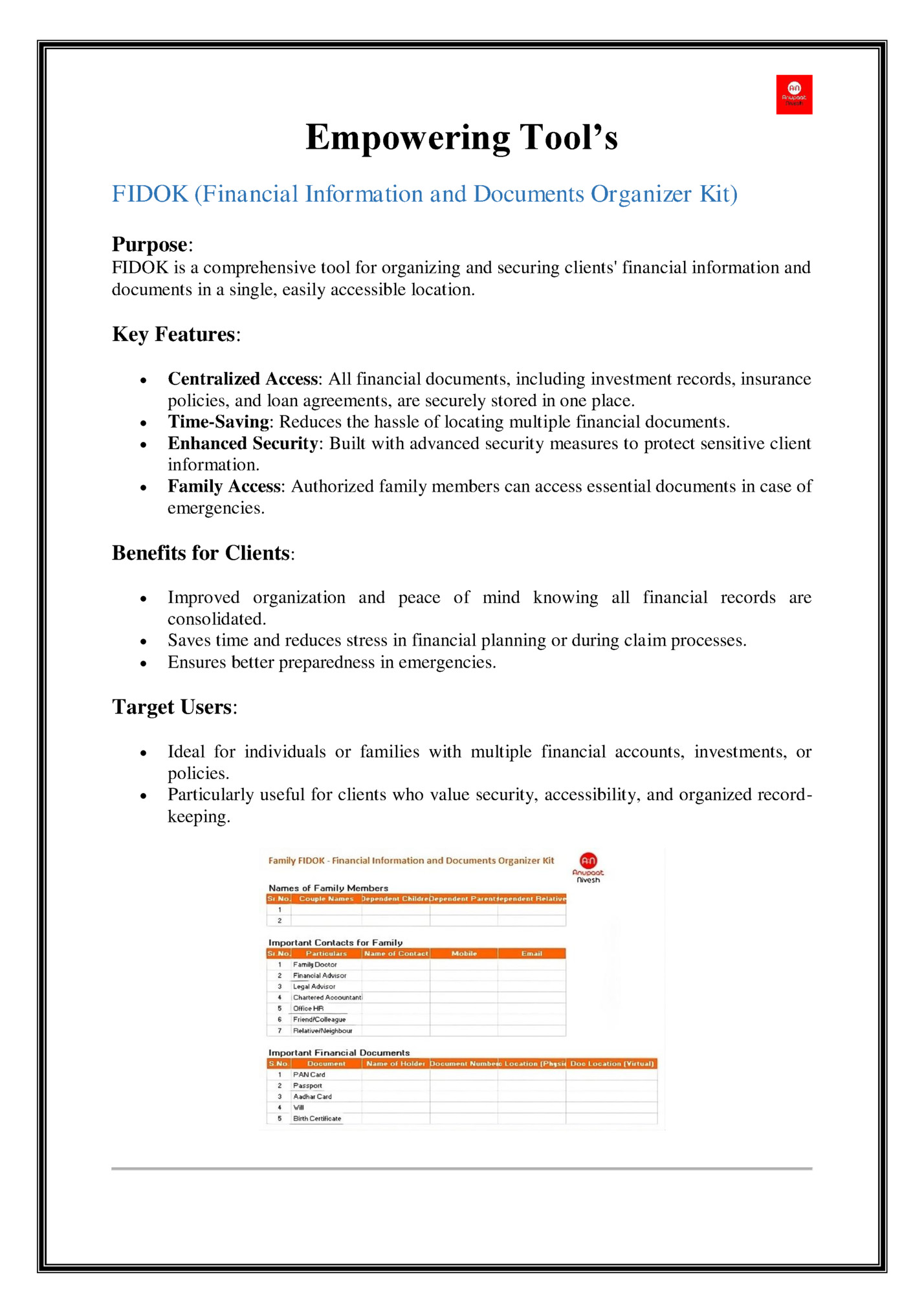

FIDOK (Financial Information and Documents Organizer Kit) Purpose: FIDOK is a comprehensive tool for organizing and securing clients' financial information and documents in a single, easily accessible location. Key Features: Centralized Access: All financial documents, including investment records, insurance policies, and loan agreements, are securely stored in one place. Time-Saving: Reduces the hassle of locating multiple financial documents. Enhanced Security: Built with advanced security measures to protect sensitive client information. Family Access: Authorized family members can access essential documents in case of emergencies. Benefits for Clients: Improved organization and peace of mind knowing all financial records are consolidated. Saves time and reduces stress in financial planning or during claim processes. Ensures better preparedness in emergencies. Target Users: Ideal for individuals or families with multiple financial accounts, investments, or policies. Particularly useful for clients who value security, accessibility, and organized recordkeeping.

Purpose: The Risk Profile Tool helps clients assess their risk tolerance and investment preferences. This tool enables personalized investment strategies by aligning portfolios with clients' comfort levels and financial goals. Key Features: Detailed Questionnaire: Assesses various factors, including age, income, financial goals, and risk tolerance. Personalized Risk Score: Generates a risk score that categorizes clients as conservative, moderate, or aggressive investors. Investment Recommendations: Based on the risk profile, clients receive suggestions for suitable products, such as mutual funds or equity plans. Benefits for Clients: Provides clients with a clear understanding of their investment comfort zone. Empowers clients to make informed decisions based on their unique financial situation. Reduces the likelihood of mismatched investments and potential financial stress. Target Users: Suitable for all clients, especially those new to investing or uncertain about their risk tolerance. Valuable for clients looking to tailor their investment strategies to meet specific goals with a comfortable risk level.

Stay informed and engaged with the latest updates, financial insights, and helpful resources by following us on social media. Our channels are dedicated to empowering you with valuable information, market updates, and practical tips to support your financial journey. YouTube: Anupaat Nivesh Channel On our YouTube channel, we regularly share educational videos, expert advice, and strategies on personal finance, mutual funds, insurance, and equity investments. Subscribe to stay updated with new content, tutorials, and in-depth guides that simplify complex financial topics. Link: https://www.youtube.com/@anupaatnivesh Instagram: @anupaatnivesh Follow us on Instagram for daily updates, quick finance tips, inspiring stories, and interactive content. Our posts and reels offer bite-sized financial advice and motivational content to keep you on track with your financial goals. Link: https://www.instagram.com/anupaatnivesh

Fleepit Digital © 2021