LUXURY MARKET REPORT JANUARY 2022 www.LuxuryHomeMarketing.com

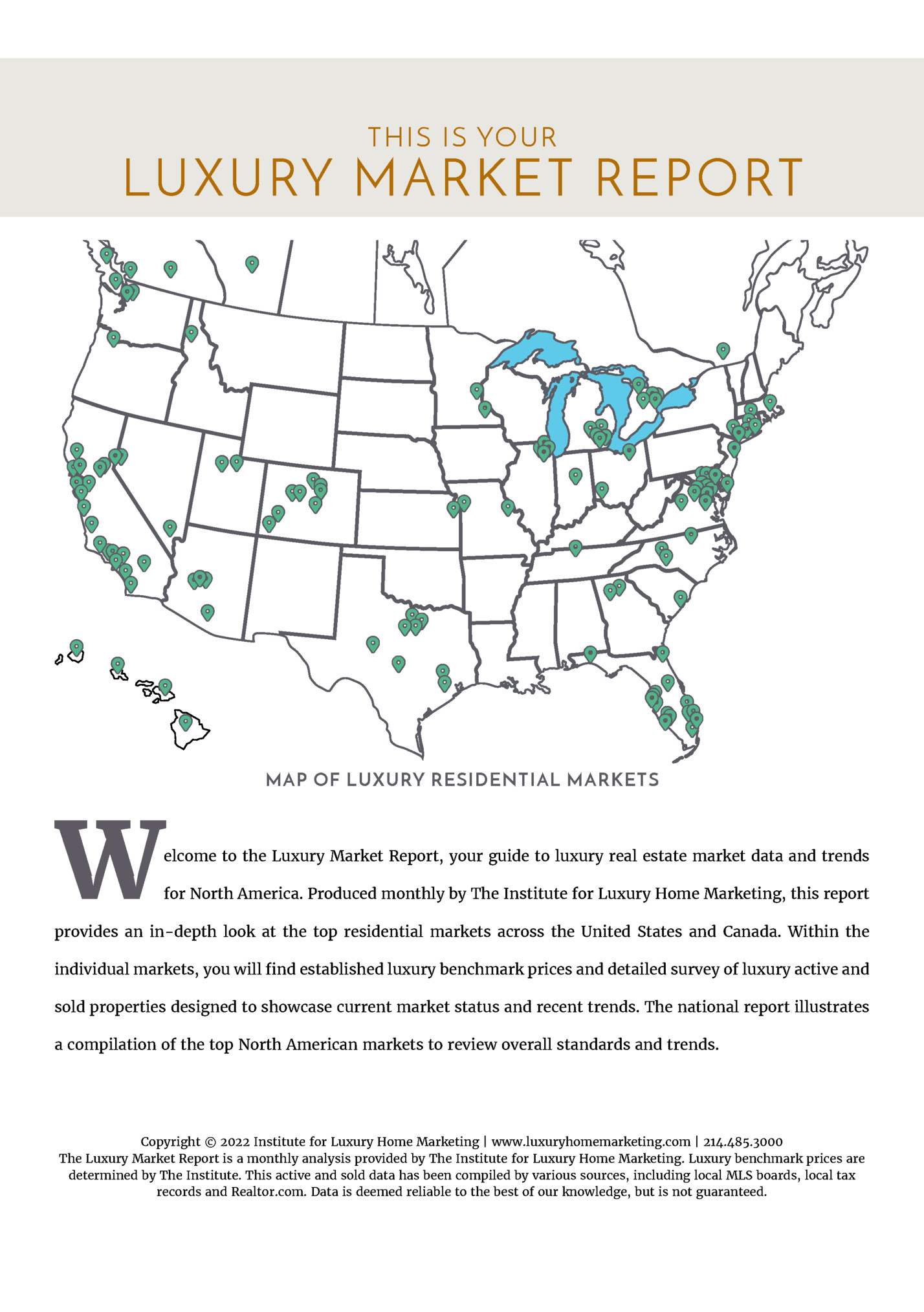

LUXURY MARKET REPORT MAP OF LUXURY RESIDENTIAL MARKETS W elcome to the Luxury Market Report, your guide to luxury real estate market data and trends for North America. Produced monthly by The Institute for Luxury Home Marketing, this report provides an in-depth look at the top residential markets across the United States and Canada. Within the individual markets, you will find established luxury benchmark prices and detailed survey of luxury active and sold properties designed to showcase current market status and recent trends. The national report illustrates a compilation of the top North American markets to review overall standards and trends. Copyright © 2022 Institute for Luxury Home Marketing | www.luxuryhomemarketing.com | 214.485.3000 The Luxury Market Report is a monthly analysis provided by The Institute for Luxury Home Marketing. Luxury benchmark prices are determined by The Institute. This active and sold data has been compiled by various sources, including local MLS boards, local tax records and Realtor.com. Data is deemed reliable to the best of our knowledge, but is not guaranteed.

The Institute for Luxury Home Marketing has analyzed a number of metrics — including sales prices, sales volumes, number of sales, sales-price-to-list-price ratios, days on market and price-per-square-foot – to provide you a comprehensive North American Luxury Market report. Additionally, we have further examined all of the individual luxury markets to provide both an overview and an in-depth analysis - including, where data is sufficient, a breakdown by luxury single-family homes and luxury attached homes. It is our intention to include additional luxury markets on a continual basis. If your market is not featured, please contact us so we can implement the necessary qualification process. More in-depth reports on the luxury communities in your market are available as well. Looking through this report, you will notice three distinct market statuses, Buyer's Market, Seller's Market, and Balanced Market. A Buyer's Market indicates that buyers have greater control over the price point. This market type is demonstrated by a substantial number of homes on the market and few sales, suggesting demand for residential properties is slow for that market and/or price point. By contrast, a Seller's Market gives sellers greater control over the price point. Typically, this means there are few homes on the market and a generous demand, causing competition between buyers who ultimately drive sales prices higher. A Balanced Market indicates that neither the buyers nor the sellers control the price point at which that property will sell and that there is neither a glut nor a lack of inventory. Typically, this type of market sees a stabilization of both the list and sold price, the length of time the property is on the market as well as the expectancy amongst homeowners in their respective communities – so long as their home is priced in accordance with the current market value. REPORT GLOSSARY REMAINING INVENTORY: The total number of homes available at the close of a month. DAYS ON MARKET: Measures the number of days a home is available on the market before a purchase offer is accepted. LUXURY BENCHMARK PRICE: The price point that marks the transition from traditional homes to luxury homes. NEW LISTINGS: The number of homes that entered the market during the current month. PRICE PER SQUARE FOOT: Measures the dollar amount of the home's price for an individual square foot. SALES RATIO: Sales Ratio defines market speed and determines whether the market currently favors buyers or sellers. Buyer's Market = up to 14%; Balanced Market = 15 to 20%; Seller's Market = 21% plus. If >100%, sales from previous month exceed current inventory. SP/LP RATIO: The Sales Price/List Price Ratio compares the value of the sold price to the value of the list price.

being ready to list, believing that their properties have reached their max ROI, and a smaller buyer demand, either because they already bought in 2021 or are looking at other locations or investment opportunities, could bring some markets into a more balanced equilibrium, with supply moving closer to demand.”

Long-Term Trends Defining the Luxury Market in 2022 Typically, in our January market report we take the time to review what occurred during the previous year and what to expect in the upcoming year. This year, however, we are going to review three key trends, how and why they came to be, and why they could possibly shape the luxury real estate market in 2022 and beyond. The luxury real estate market had an outstanding year in 2021, probably one of the strongest years with historic price increases in both the single family and attached markets, and sold properties recorded numbers above 2020 despite an unprecedented decline of inventory levels. WILL INVENTORY LEVELS INCREASE? Inventory levels started to decrease in October/November 2020. However, what was different to typical years was that the level of sales did not decline, even in the attached market, which, during the first six to seven months of pandemic, had come close to a standstill. Equally, the level of new inventory entering the market was starting to show a serious differential against the level of sales. The beginning of 2021 marked the start of a trend that came to affect the level of sales for the rest of the year. When the spring season arrived, the new inventory levels failed to reach typical levels and demand escalated to a frenzy. By July, the luxury market started to calm down, however as inventory levels hardly rose, sales still outpaced inventory. This trend continued and by the end of 2021, a significant number of markets have less than 50-70% inventory compared to the end of 2020.

quick sales, and increased prices? Let us look at a few changed parameters that may cool this redhot market. Firstly, the average price for single-family homes in the top 10% of the North American market have risen close to 25% to approximately $1.7 million and attached properties in the top 10% have risen 15% to approximately $1 million. Even in the luxury market, there is always a natural threshold cap, where even the affluent start to question the viability of purchasing at what may be the top of the market. Mostly, the affluent do not NEED to buy a property, instead they are searching for a property with desirable attributes, which usually includes a good investment return potential. If not found, they will find an alternative or wait. For instance, in 2021, new luxury communities, neighborhoods, and enclaves appeared as the affluent chose to invest away from highly competitive markets. Secondly, it is likely that the convergence of more sellers being ready to list, believing that their properties have reached their max ROI, and a smaller buyer demand, either because they already bought in 2021 or are looking at other locations or investment opportunities, could bring some markets into a more balanced equilibrium, with supply moving closer to demand. More inventory could be self-reinforcing as sellers recognize that in order to buy a new home that they need to put themselves in a more competitive state, which often means they need to sell their home and become cash buyers. Lastly, 2022 will see the benefit of new inventory heading into the market. Both builders and developers, now that supply lines issues for materials have eased and the trends of luxury buyer requirements have been established, are keen to complete new projects. MIGRATION, RELOCATIONS AND EMERGING LUXURY MARKETS One of the largest trends to unfold from the pandemic was the significant movement of individuals. The affluent, often leaders of new trends, were certainly the first to extract themselves from densely populated markets, relocating to exurban areas until they could establish the impact of COVID-19 on their lifestyles.

their plans from downsizing, migrating to another state for the weather, taxes, jobs, or a change of lifestyle, to investing in new emerging markets, which were already attracting residential and commercial opportunities. As trends such as remote working and flexi-hours took hold in 2021, so too did the flexibility of relocating as well as the growth of second homeownership. According to a recent report — A Look at Wealth 20211 — over 70% of individuals in the US with a net worth over $5 million now own at least two homes. It could be fair to say that this percentage might be similar in Canada, given that both countries have a 10% national rate of second home ownership. Heading into 2022, the trend for new ownership is considered to be an integral part of the ongoing strength of the luxury real estate market. The growth of wealth, as well as the number of new wealthy buyers entering the luxury market has continued to grow and these buyers are putting more stock in homeownership than ever before. These new affluent will continue to underpin the market as they look to either upgrade their current home, buy additional properties, find investment opportunities, and/or divest their newfound wealth in crypto-currencies and the like, into the more stable asset of property ownership. On the other side, are the homeowners who decided not to sell their properties during the height of the pandemic, but who are now ready to realize their equity by selling and either relocating, downsizing, or both during 2022. Another trend important for the upcoming year is the desire for multiple ownership. The affluent who are able to work remotely are now setting up co-primary homes that allow them the flexibility of choosing to live in multiple markets that offer different lifestyles — whether that is city, countryside, mountain, lake, beach, or resort life.

of the relocation of a major corporation or a new business center start-up. These markets are not only attracting new residents, but also providing opportunities for the affluent to set up subsidiary businesses while taking advantage of more affordable luxury properties. HEALTH, WELLNESS, SUSTAINABILITY AND THE ENVIRONMENT 2021 saw many discussions about the state of our environment, the abuse of our health, wellness, and natural resources — which in many ways was also forced to the forefront by the pandemic. In 2020 and 2021, luxury developers and residential and commercial builders — especially in the high-rise sector – began to recognize that individuals were no longer comfortable in small spaces or sharing common areas and there was a growing concern about the quality of control of amenities such as heating, ventilation, and air quality. Equally, it has been acknowledged that the building sector currently contributes nearly 40% of carbon emissions globally, with 70% of these in urban areas. In 2022, the real estate industry’s leadership — the Urban Land Institute, a worldwide alliance of leading real estate owners, investors, and strategic partners — has committed to providing guidance on prioritizing sustainable development and operational practices to help inform sustainable policies at all levels of government, especially local. In a recent study by Google, 82% of shoppers said that sustainability is a bigger focus for them now than it was before the pandemic.2 Growing trends amongst the wealthy, which clearly show an understanding of environmental and sustainability issues, could once again prove to be the leadership that directs luxury industries into rethinking and implementing new sustainable practices in their processes – and as with other trends if these prove to have longevity then they will filter down into other industry sectors. In conclusion, 2022 may still prove to be an uneasy year, as the world still faces many uncertainties from the pandemic, environmentally, economically as well as politically, but there are bright spots as there is refocus on how, not just the affluent, but individuals in general are recognizing the need for social and environment change. 1 https://blog.coldwellbankerluxury.com/a-look-at-wealth-2021-real-estates-new-power-players/ 2 https://www.thinkwithgoogle.com/consumer-insights/consumer-trends/consumer-sustainability-trends/

FOR THE LUXURY NORTH AMERICAN MARKET Single-Family Homes Attached Homes Single-Family List Price Attached List Price All data is based off median values. Median prices represent properties priced above respective city benchmark prices. 40 19 20 21 11 10 13 DEC JAN FEB APR MAR 11 12 MAY 16 10 12 JUN 14 16 12 14 JUL 15 12 AUG SEP 17 14 15 OCT 16 NOV DEC $556 $436 $430 $416 $501 $514 $540 $423 $406 $486 $492 $385 $404 $406 $495 $513 $386 $398 $483 $496 $392 $300 $375 $400 $492 $500 $521 $600 $489 PRICE PER SQUARE FOOT 37 33 $386 DAYS ON MARKET 34 0 $200 $100 $0 SALES PRICE VS. LIST PRICE 35 36 34 DEC JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC $2,100,000 $1,900,000 $1,700,000 $1,500,000 $1,300,000 $1,100,000 $900,000 $700,000 $500,000 DEC JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC Discrepancies in previous month statistics between the December 2021 and January 2022 reports are due to the addition of Telluride, CO and Lake Norman, NC.

Fleepit Digital © 2021