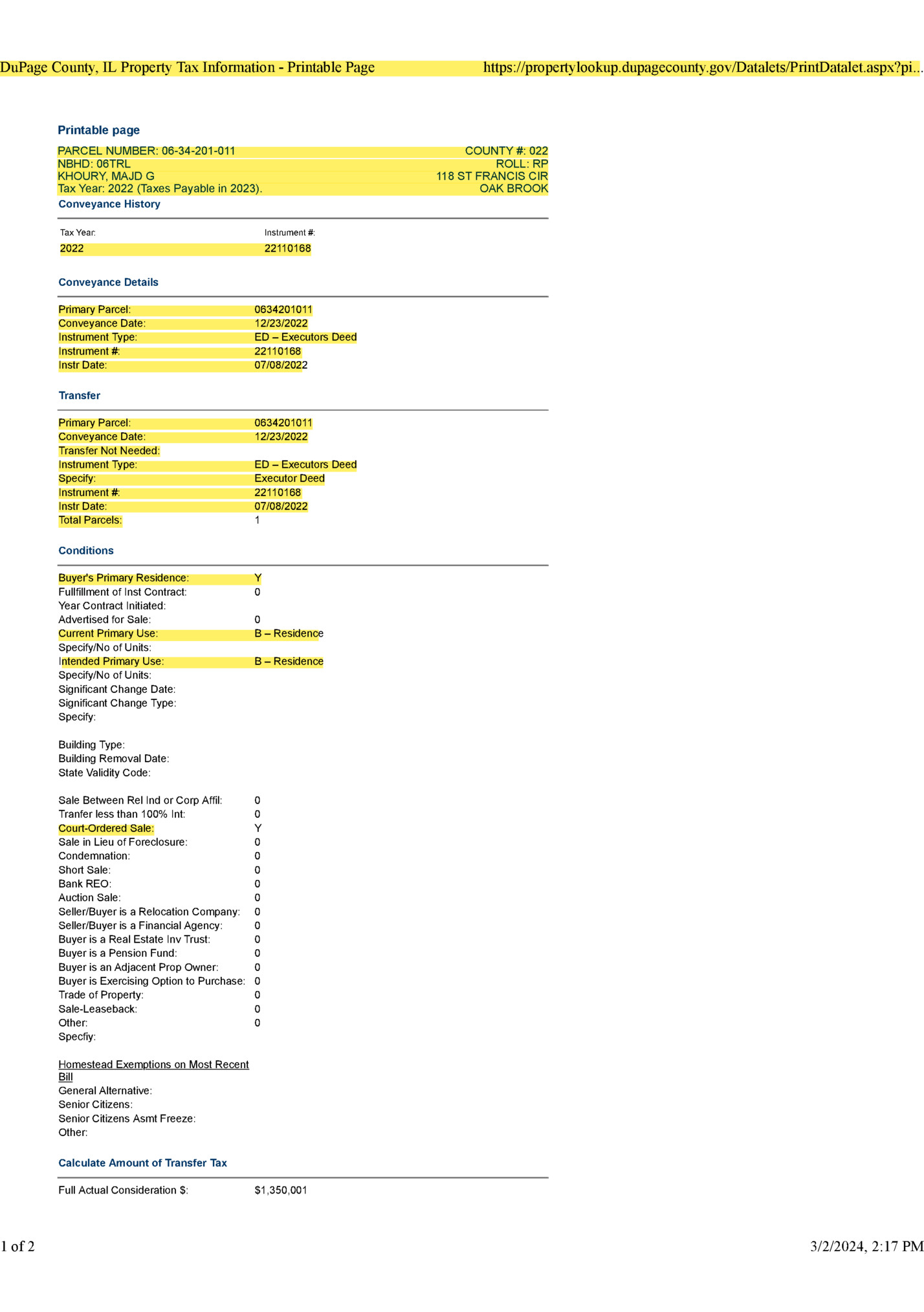

1 of 2 https://propertylookup.dupagecounty.gov/Datalets/PrintDatalet.aspx?pi... Printable page PARCEL NUMBER: 06-34-201-011 NBHD: 06TRL KHOURY, MAJD G Tax Year: 2022 (Taxes Payable in 2023). COUNTY #: 022 ROLL: RP 118 ST FRANCIS CIR OAK BROOK Conveyance History Tax Year: Instrument #: 2022 22110168 Conveyance Details Primary Parcel: Conveyance Date: Instrument Type: Instrument #: Instr Date: 0634201011 12/23/2022 ED – Executors Deed 22110168 07/08/2022 Transfer Primary Parcel: Conveyance Date: Transfer Not Needed: Instrument Type: Specify: Instrument #: Instr Date: Total Parcels: 0634201011 12/23/2022 ED – Executors Deed Executor Deed 22110168 07/08/2022 1 Conditions Buyer's Primary Residence: Fullfillment of Inst Contract: Year Contract Initiated: Advertised for Sale: Current Primary Use: Specify/No of Units: Intended Primary Use: Specify/No of Units: Significant Change Date: Significant Change Type: Specify: Y 0 0 B – Residence B – Residence Building Type: Building Removal Date: State Validity Code: Sale Between Rel Ind or Corp Affil: Tranfer less than 100% Int: Court-Ordered Sale: Sale in Lieu of Foreclosure: Condemnation: Short Sale: Bank REO: Auction Sale: Seller/Buyer is a Relocation Company: Seller/Buyer is a Financial Agency: Buyer is a Real Estate Inv Trust: Buyer is a Pension Fund: Buyer is an Adjacent Prop Owner: Buyer is Exercising Option to Purchase: Trade of Property: Sale-Leaseback: Other: Specfiy: 0 0 Y 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Homestead Exemptions on Most Recent Bill General Alternative: Senior Citizens: Senior Citizens Asmt Freeze: Other: Calculate Amount of Transfer Tax Full Actual Consideration $: $1,350,001 3/2/2024, 2:17 PM

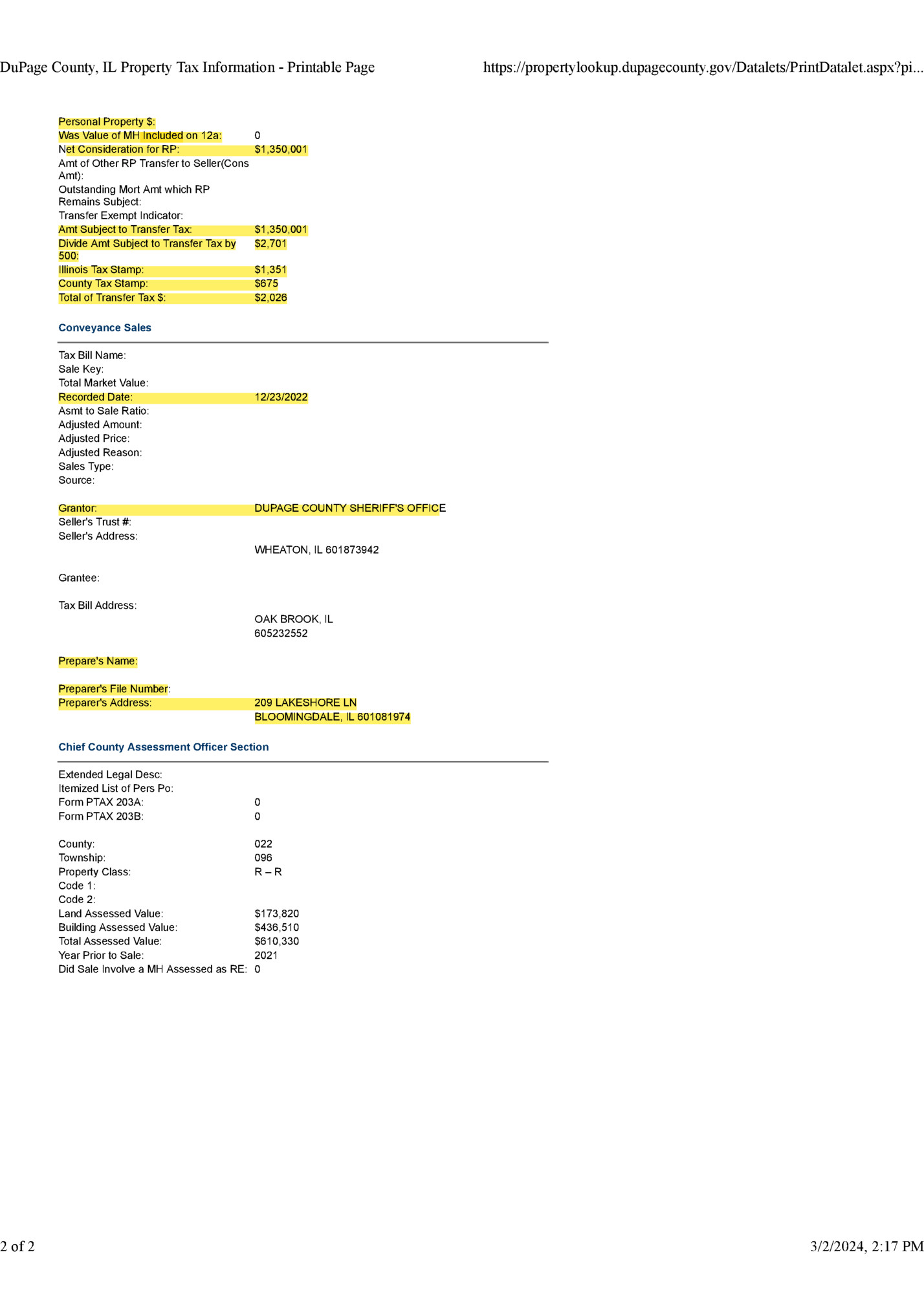

2 of 2 Personal Property $: Was Value of MH Included on 12a: Net Consideration for RP: Amt of Other RP Transfer to Seller(Cons Amt): Outstanding Mort Amt which RP Remains Subject: Transfer Exempt Indicator: Amt Subject to Transfer Tax: Divide Amt Subject to Transfer Tax by 500: Illinois Tax Stamp: County Tax Stamp: Total of Transfer Tax $: https://propertylookup.dupagecounty.gov/Datalets/PrintDatalet.aspx?pi... 0 $1,350,001 $1,350,001 $2,701 $1,351 $675 $2,026 Conveyance Sales Tax Bill Name: Sale Key: Total Market Value: Recorded Date: Asmt to Sale Ratio: Adjusted Amount: Adjusted Price: Adjusted Reason: Sales Type: Source: Grantor: Seller's Trust #: Seller's Address: 12/23/2022 DUPAGE COUNTY SHERIFF'S OFFICE WHEATON, IL 601873942 Grantee: Tax Bill Address: OAK BROOK, IL 605232552 Prepare's Name: Preparer's File Number: Preparer's Address: 209 LAKESHORE LN BLOOMINGDALE, IL 601081974 Chief County Assessment Officer Section Extended Legal Desc: Itemized List of Pers Po: Form PTAX 203A: Form PTAX 203B: County: Township: Property Class: Code 1: Code 2: Land Assessed Value: Building Assessed Value: Total Assessed Value: Year Prior to Sale: Did Sale Involve a MH Assessed as RE: 0 0 022 096 R–R $173,820 $436,510 $610,330 2021 0 3/2/2024, 2:17 PM

Fleepit Digital © 2021