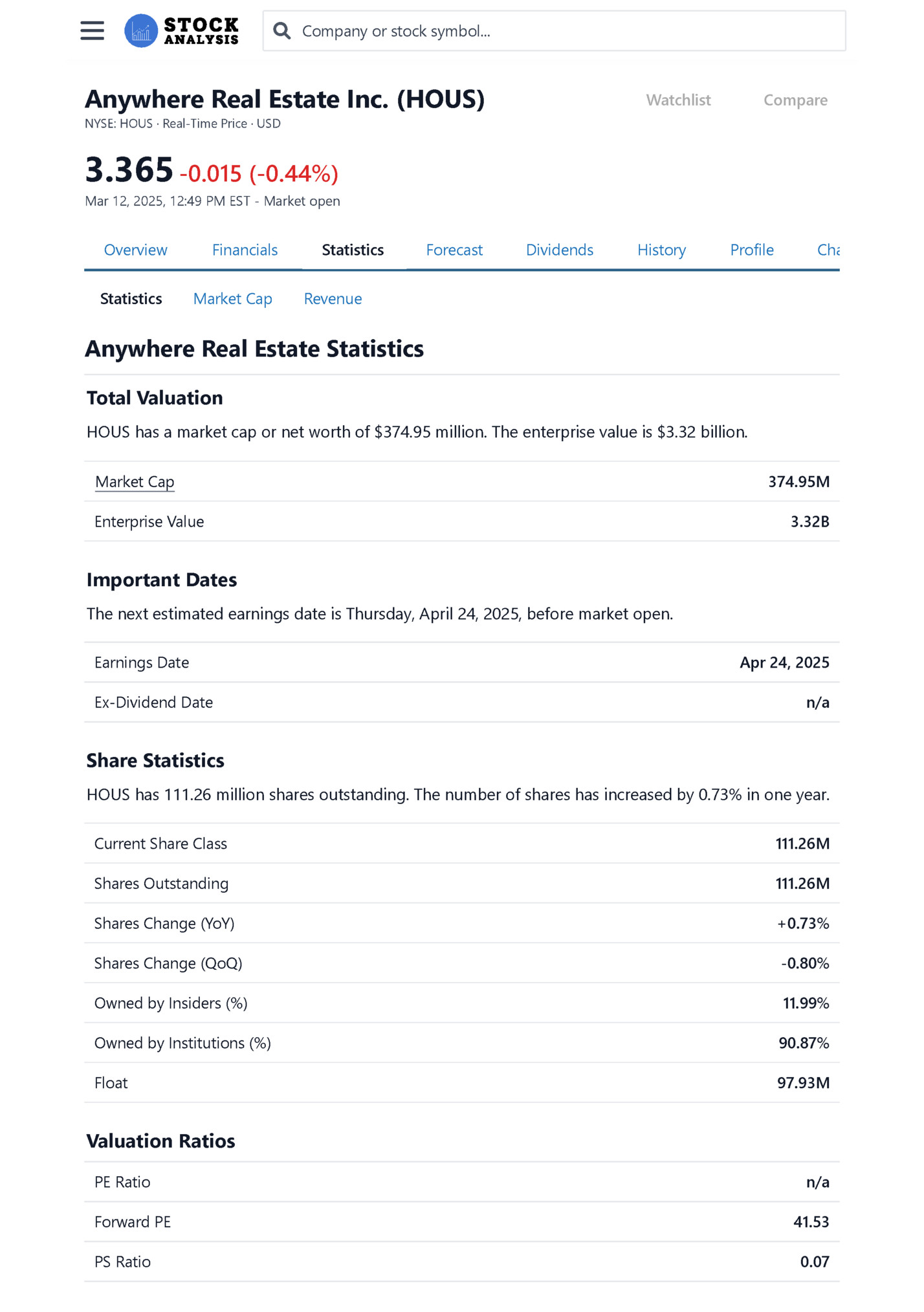

Anywhere Real Estate Inc. (HOUS) Watchlist Compare NYSE: HOUS · Real-Time Price · USD 3.365 -0.015 (-0.44%) Mar 12, 2025, 12:49 PM EST - Market open Overview Statistics Financials Market Cap Statistics Forecast Dividends History Profile Cha Revenue Anywhere Real Estate Statistics Total Valuation HOUS has a market cap or net worth of $374.95 million. The enterprise value is $3.32 billion. Market Cap Enterprise Value 374.95M 3.32B Important Dates The next estimated earnings date is Thursday, April 24, 2025, before market open. Earnings Date Ex-Dividend Date Apr 24, 2025 n/a Share Statistics HOUS has 111.26 million shares outstanding. The number of shares has increased by 0.73% in one year. Current Share Class 111.26M Shares Outstanding 111.26M Shares Change (YoY) +0.73% Shares Change (QoQ) -0.80% Owned by Insiders (%) 11.99% Owned by Institutions (%) 90.87% Float 97.93M Valuation Ratios PE Ratio Forward PE PS Ratio n/a 41.53 0.07

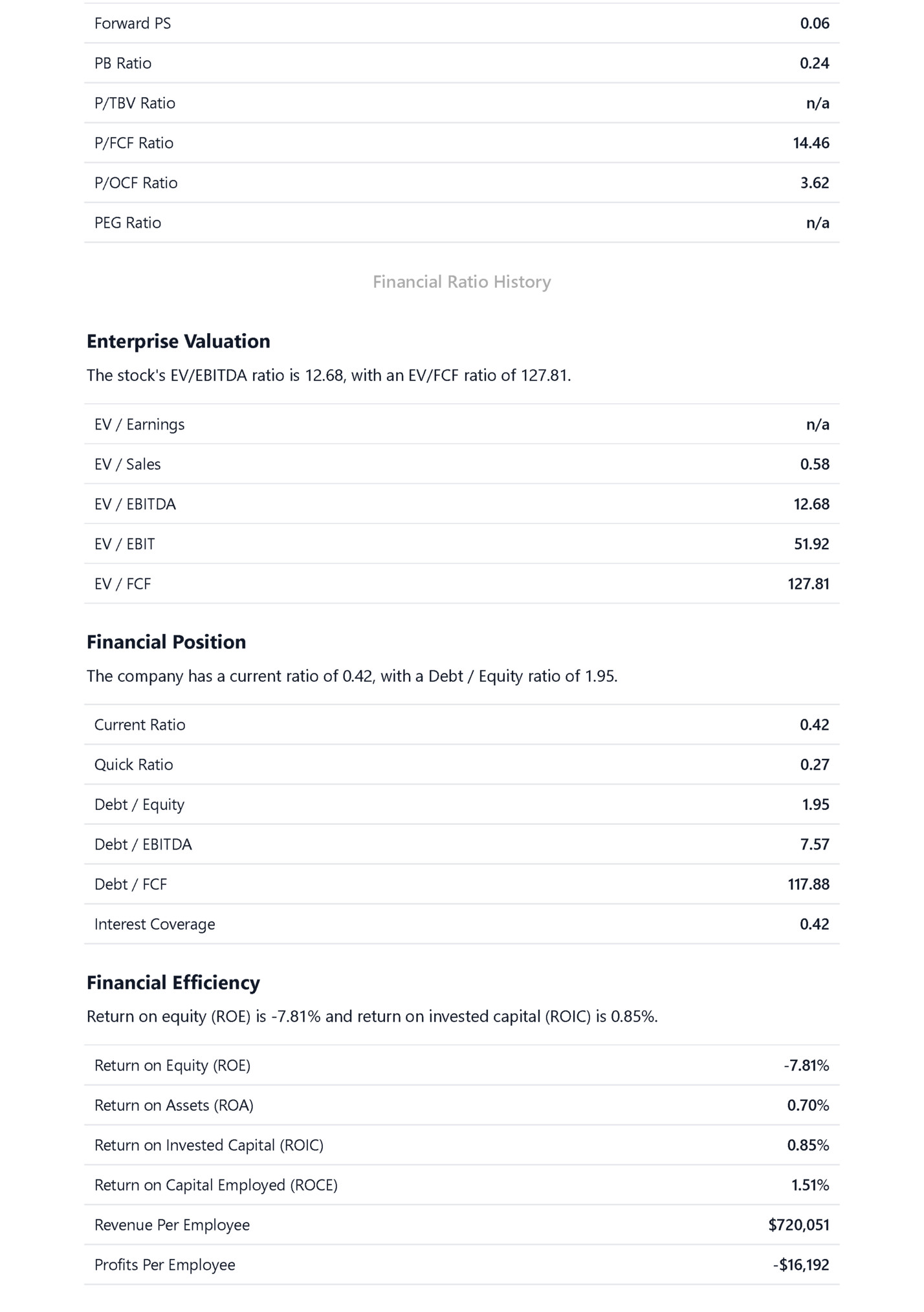

0.06 PB Ratio 0.24 P/TBV Ratio n/a P/FCF Ratio 14.46 P/OCF Ratio 3.62 PEG Ratio n/a Financial Ratio History Enterprise Valuation The stock's EV/EBITDA ratio is 12.68, with an EV/FCF ratio of 127.81. EV / Earnings EV / Sales n/a 0.58 EV / EBITDA 12.68 EV / EBIT 51.92 EV / FCF 127.81 Financial Position The company has a current ratio of 0.42, with a Debt / Equity ratio of 1.95. Current Ratio 0.42 Quick Ratio 0.27 Debt / Equity 1.95 Debt / EBITDA 7.57 Debt / FCF Interest Coverage 117.88 0.42 Financial Efficiency Return on equity (ROE) is -7.81% and return on invested capital (ROIC) is 0.85%. Return on Equity (ROE) -7.81% Return on Assets (ROA) 0.70% Return on Invested Capital (ROIC) 0.85% Return on Capital Employed (ROCE) 1.51% Revenue Per Employee $720,051 Profits Per Employee -$16,192

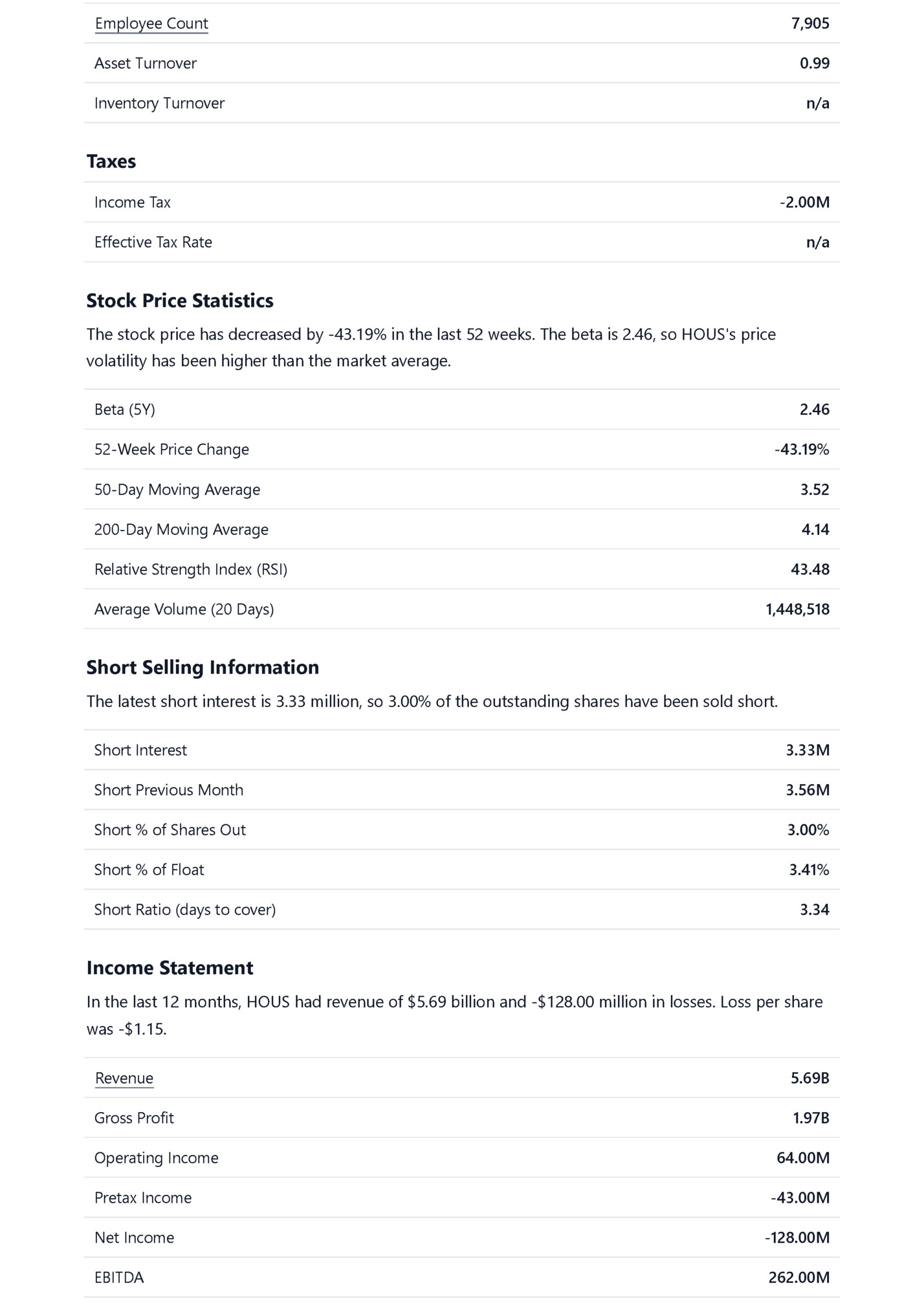

7,905 Asset Turnover 0.99 Inventory Turnover n/a Taxes Income Tax -2.00M Effective Tax Rate n/a Stock Price Statistics The stock price has decreased by -43.19% in the last 52 weeks. The beta is 2.46, so HOUS's price volatility has been higher than the market average. Beta (5Y) 52-Week Price Change 2.46 -43.19% 50-Day Moving Average 3.52 200-Day Moving Average 4.14 Relative Strength Index (RSI) Average Volume (20 Days) 43.48 1,448,518 Short Selling Information The latest short interest is 3.33 million, so 3.00% of the outstanding shares have been sold short. Short Interest 3.33M Short Previous Month 3.56M Short % of Shares Out 3.00% Short % of Float 3.41% Short Ratio (days to cover) 3.34 Income Statement In the last 12 months, HOUS had revenue of $5.69 billion and -$128.00 million in losses. Loss per share was -$1.15. Revenue 5.69B Gross Profit 1.97B Operating Income Pretax Income 64.00M -43.00M Net Income -128.00M EBITDA 262.00M

64.00M Loss Per Share -$1.15 Full Income Statement Balance Sheet The company has $118.00 million in cash and $3.07 billion in debt, giving a net cash position of -$2.95 billion or -$26.49 per share. Cash & Cash Equivalents 118.00M Total Debt 3.07B Net Cash -2.95B Net Cash Per Share -$26.49 Equity (Book Value) 1.57B Book Value Per Share 14.08 Working Capital -808.00M Full Balance Sheet Cash Flow In the last 12 months, operating cash flow was $104.00 million and capital expenditures -$78.00 million, giving a free cash flow of $26.00 million. Operating Cash Flow 104.00M Capital Expenditures -78.00M Free Cash Flow 26.00M FCF Per Share $0.23 Full Cash Flow Statement Margins Gross margin is 34.68%, with operating and profit margins of 1.12% and -2.25%. Gross Margin Operating Margin 34.68% 1.12% Pretax Margin -2.27% Profit Margin -2.25% EBITDA Margin EBIT Margin 4.60% 1.12%

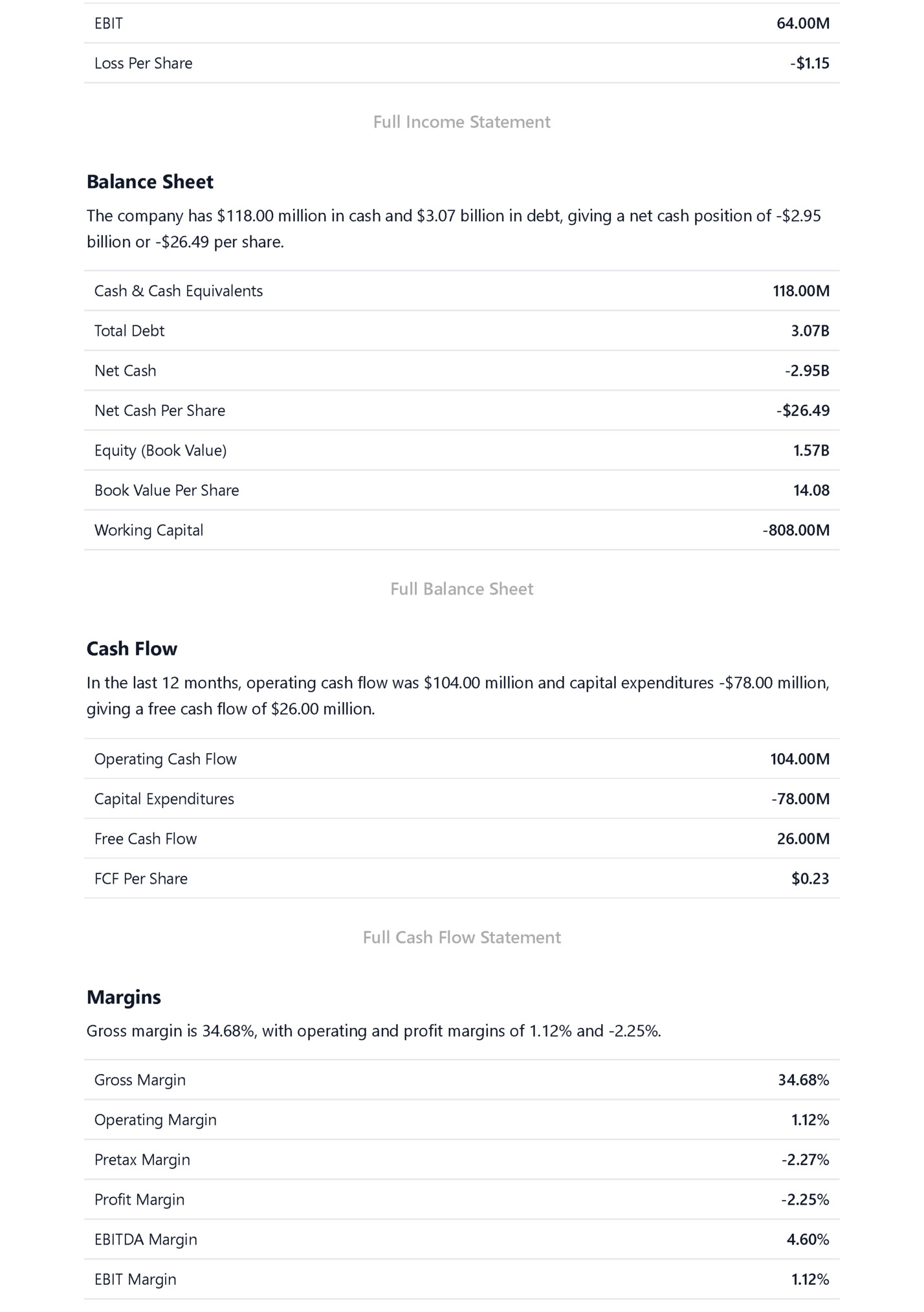

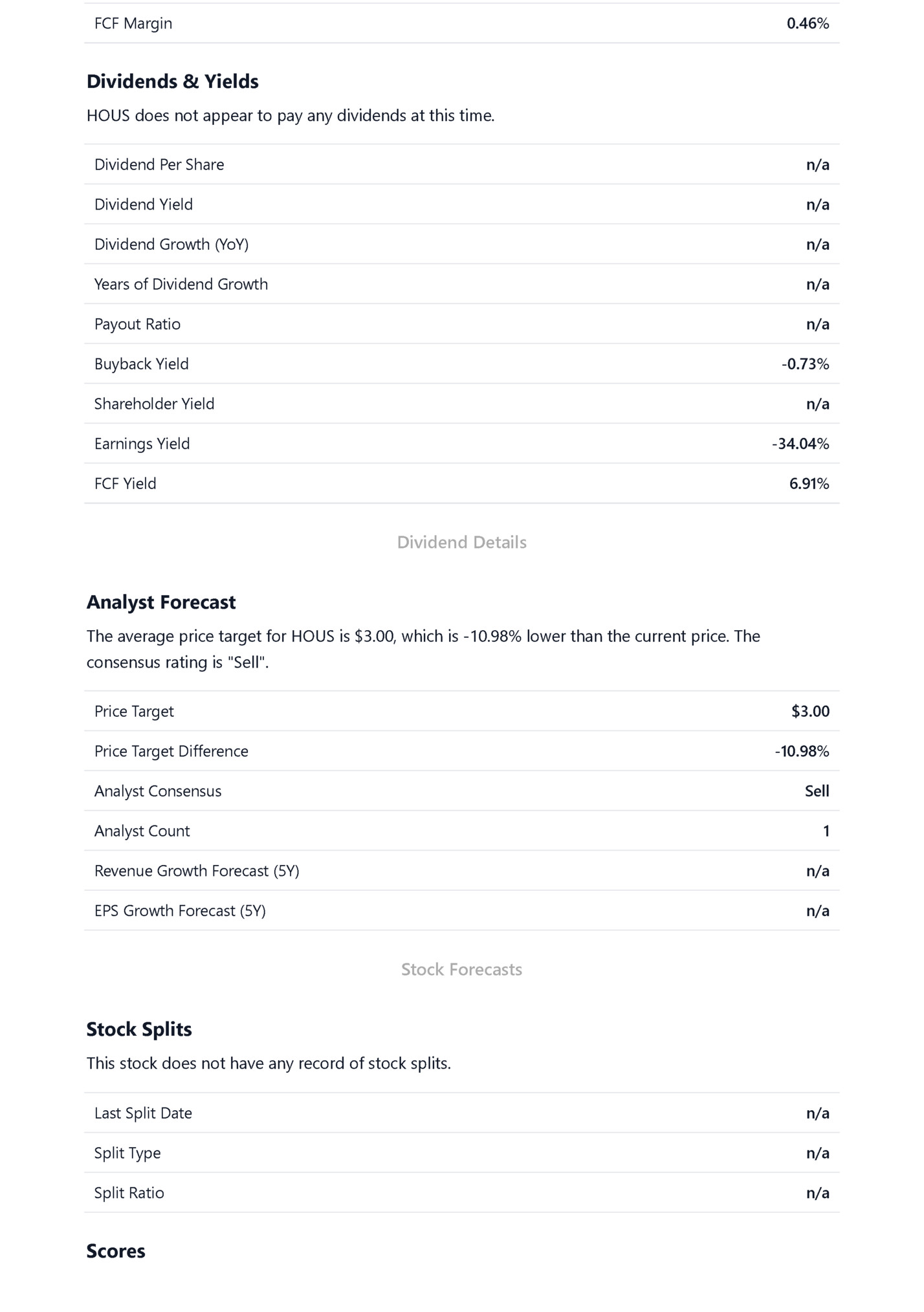

0.46% Dividends & Yields HOUS does not appear to pay any dividends at this time. Dividend Per Share n/a Dividend Yield n/a Dividend Growth (YoY) n/a Years of Dividend Growth n/a Payout Ratio n/a Buyback Yield -0.73% Shareholder Yield n/a Earnings Yield -34.04% FCF Yield 6.91% Dividend Details Analyst Forecast The average price target for HOUS is $3.00, which is -10.98% lower than the current price. The consensus rating is "Sell". Price Target $3.00 Price Target Difference -10.98% Analyst Consensus Sell Analyst Count 1 Revenue Growth Forecast (5Y) n/a EPS Growth Forecast (5Y) n/a Stock Forecasts Stock Splits This stock does not have any record of stock splits. Last Split Date n/a Split Type n/a Split Ratio n/a Scores

increased risk of bankruptcy. Altman Z-Score 0.16 Piotroski F-Score 5 SECTIONS SERVICES WEBSITE COMPANY Stocks StockAnalysis Pro Login About IPOs Free Newsletter FAQ Contact Us ETFs Get Support Changelog Terms of Use Sitemap Privacy Policy Advertise Data Disclaimer Blog MARKET NEWSLETTER Daily market news in bullet point format. Enter your email © 2025 StockAnalysis. All rights reserved. Subscribe

Fleepit Digital © 2021