TAXANGLES A newsletter for proactive planning... In this edition... August 2021 Issue RTI penalties and period of grace Collection of tax debts post Covid-19 Pension annual allowance – Making tax relieved contributions Do I need to register for VAT? Making mileage payments to employees How it all began- We catch up with former MD and founder, Jeff Walton Compass celebrates its 40th Anniversary Tax Diary- August 2021 www.compassaccountants.co.uk 40th Anniversary edition

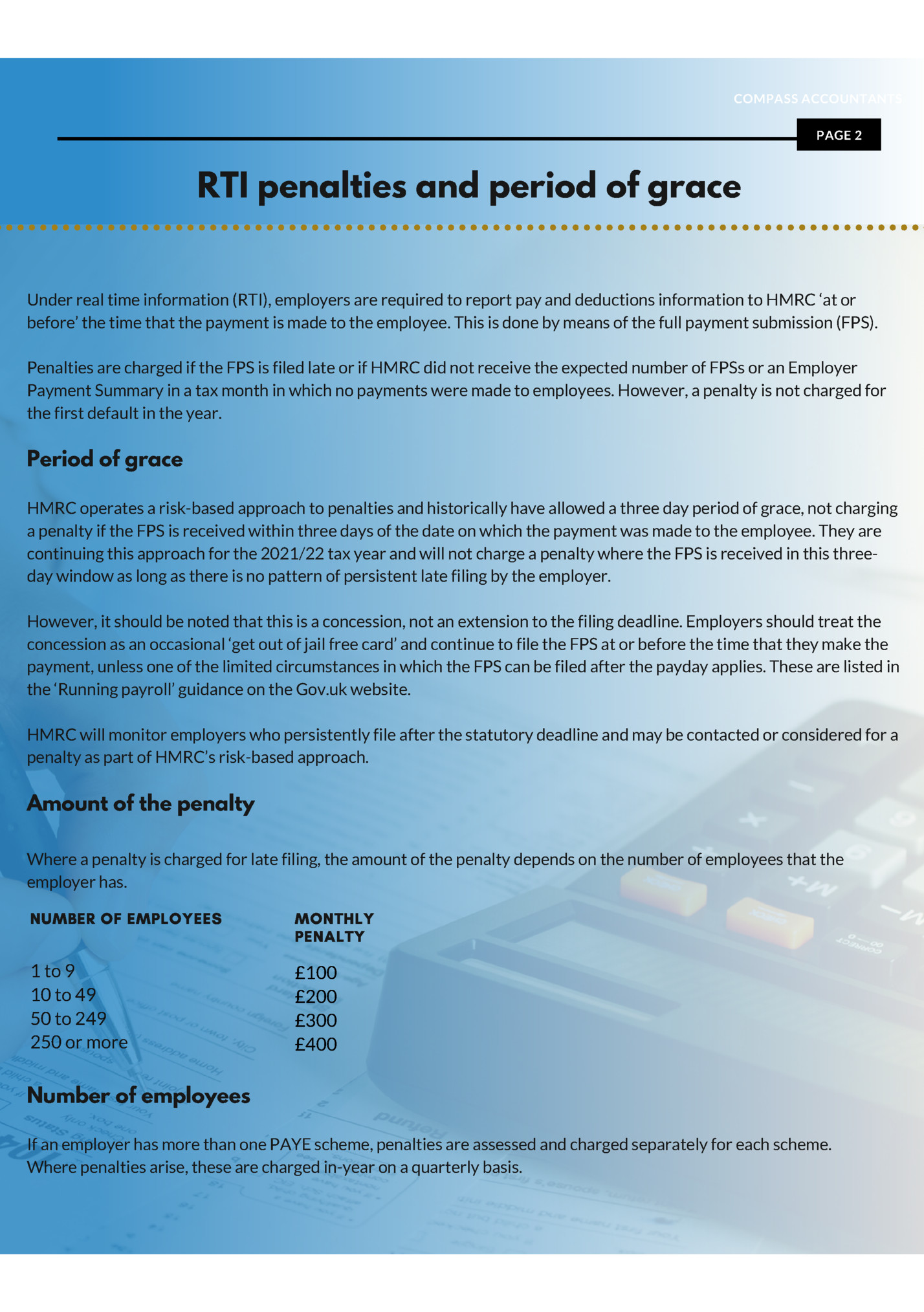

PAGE 2 RTI penalties and period of grace Under real time information (RTI), employers are required to report pay and deductions information to HMRC ‘at or before’ the time that the payment is made to the employee. This is done by means of the full payment submission (FPS). Penalties are charged if the FPS is filed late or if HMRC did not receive the expected number of FPSs or an Employer Payment Summary in a tax month in which no payments were made to employees. However, a penalty is not charged for the first default in the year. Period of grace HMRC operates a risk-based approach to penalties and historically have allowed a three day period of grace, not charging a penalty if the FPS is received within three days of the date on which the payment was made to the employee. They are continuing this approach for the 2021/22 tax year and will not charge a penalty where the FPS is received in this threeday window as long as there is no pattern of persistent late filing by the employer. However, it should be noted that this is a concession, not an extension to the filing deadline. Employers should treat the concession as an occasional ‘get out of jail free card’ and continue to file the FPS at or before the time that they make the payment, unless one of the limited circumstances in which the FPS can be filed after the payday applies. These are listed in the ‘Running payroll’ guidance on the Gov.uk website. HMRC will monitor employers who persistently file after the statutory deadline and may be contacted or considered for a penalty as part of HMRC’s risk-based approach. Amount of the penalty Where a penalty is charged for late filing, the amount of the penalty depends on the number of employees that the employer has. SEEYOLPME FO REBMUN YTLANEP YLHTNOM 1 to 9 10 to 49 50 to 249 250 or more £100 £200 £300 £400 Number of employees If an employer has more than one PAYE scheme, penalties are assessed and charged separately for each scheme. Where penalties arise, these are charged in-year on a quarterly basis.

PAGE 3 Collection of tax debts post Covid-19 During the Covid-19 pandemic, HMRC paused much of their tax collection work, both to allow resources to be diverted to other activities, such as administering the various coronavirus support initiatives, such as the Coronavirus Job Retention Scheme and the SelfEmployment Income Support Scheme, and to provide those whose finances were adversely affected by the pandemic with a bit of breathing space. However, as the country starts to emerge from the pandemic HMRC have once again turned their focus to the collection of tax debts, publishing a policy paper setting out their approach. Contact from HMRC HMRC will generally contact taxpayers who have unpaid tax bills and who have not come to an agreement with HMRC regarding the payment of those bills. The contact may be by post, by phone or by text. Anyone who receives contact that purports to be from HMRC should check that the contact is genuine – HMRC has published guidance on the Gov.uk website containing tips to spot approaches that may be fraudulent. Any contact from HMRC should not be ignored – HMRC will deal with taxpayers who work with them more favourably than those who resist attempts to get in touch. Those that do resist may be visited by an HMRC officer. Ideally, taxpayers who are struggling to pay should contact HMRC to broker an agreement rather than waiting for HMRC to contact them. Pay if you can The briefing makes it clear that HMRC expect those taxpayers who are behind with their tax bills to pay the tax that they owe if they can. Being able to pay may involve taking advantage of the financial support packages available and taking out a loan, such as one under the Recovery Loan Scheme, to provide the necessary funds to clear the tax debt. If a taxpayer needs time to arrange a loan, HMRC may agree to defer the debt for a short period of time until the finance is agreed. Set up a time-to-pay arrangement If the taxpayer is unable to pay the outstanding tax in full, they may be able to agree a time-to-pay arrangement with HMRC allowing payment to be made in instalments. If the client has already been approached by HMRC, they should contact the tax office that sent the communication to discuss setting up a time-to-pay arrangement. Otherwise, they can contact HMRC’s Payment Support Service (0300 200 3825). When making the call, the taxpayer should have their unique taxpayer reference and bank details to hand. HMRC will want to know the amount of the bill that they are struggling to pay and why they are having problems paying it. They will also want to know what the client has done to try and get the money together. They will also take into account how much the client can pay immediately, and how long they may need to pay the outstanding balance. Once a time-to-pay arrangement has been agreed, it is important that payments are made on time in accordance with the arrangement. Failure to do so may trigger enforcement action. Enforcement action If the taxpayer fails to communicate with HMRC or stick to the terms of an arrangement, from September 2021, HMRC may also take enforcement action to recover the debt. They have a range of powers available, including taking control of goods, summary warrants and court action (including insolvency proceedings). While HMRC will endeavour to support viable businesses, if they judge that a business has little chance of recovery, they will act to seek to recover any tax that may be due.

PAGE 4 Tax relief is available to encourage individuals to make contributions to registered private pension plans. However, while there is no limit to the amount that an individual can contribute to their pension plans, there are limits on the contributions that qualify for tax relief. One of those limits is the annual allowance. Tax relieved contributions for a tax year cannot exceed the higher of 100% of earnings or £3,600, and must be covered by the available annual allowance. Nature of the annual allowance The annual allowance limits the amount that an individual can make in tax-relieved pension contributions across all their registered pension schemes. The basic annual allowance is set at £40,000 for 2021/22. However, an individual’s annual allowance may be less than this if they are a high earner or if they have already flexibly accessed their pension. If an individual has not used up their annual allowance in the previous three years, they may be able to make tax relieved contributions of more than £40,000 in 2021/22. However, where earnings are less than the available annual allowance, tax-relieved contributions are capped at earnings (or £3,600 where this is amount is more than earnings). Only one annual allowance is available regardless of the number of registered private pensions that an individual has. The annual allowance applies to total contributions made to a defined contribution scheme in the tax year and any increase in the value of a defined benefit scheme in the tax year. Pension contributions made by an employer to a private pension scheme count towards the annual allowance. High earners The amount of the annual allowance is reduced where, for the tax year in question, a person has both adjusted net income of more than £240,000 and threshold income of more than £200,000. Broadly, adjusted net income is income including pension contributions and threshold income is income excluding pension contributions. Where both tests are met, the annual allowance is reduced by £1 for every £2 by which adjusted net income exceeds £240,000 until the minimum amount of the annual allowance is reached. For 2021/22, this is set at £4,000. No reduction is made to the annual allowance if the threshold income is £200,000 or less, regardless of the level of adjusted net income. Consequently, anyone with adjusted net income of £312,000 and threshold income of more than £200,000 will have an annual allowance of £4,000 for 2021/22. Continued on page 5...

PAGE 4 PAGE 5 Money purchase annual allowance A lower annual allowance, the money purchase annual allowance (MPAA), also applies if a person has flexibly accessed their pension on reaching age 55 or above. This is to prevent recycling of contributions to secure further tax relief. For 2021/22, the MPAA is set at £4,000. Unused annual allowances If a person has not used their annual allowance in full for a year, the unused amount can be carried forward for up to three years. However, unused allowance for earlier years can only be used once the allowance for the current year has been used in full. Unused allowances from an earlier year are used before those of a later year. Contributions in excess of the annual allowance If tax-relieved contributions are made in a tax year in excess of the available annual allowance for that year, a tax charge applies to claw back the tax relief to which the individual was not entitled. Making mileage payments to employees As the country emerges from the Covid-19 pandemic, business travel is once again on the agenda. Where employees undertake business travel, they will usually be able to claim the associated expenses from their employer. If the journey is by car, the easiest way to do this is for the employer to pay a mileage allowance for the business miles undertaken. Where a mileage allowance is paid, there may be tax consequences depending on the amount that is paid. The rules differ depending on whether the employee uses their own car for business travel or has a company car. Employee uses their own car The Approved Mileage Allowance Payments (AMAP) scheme allows employers to make tax-free mileage payments up to an ‘approved amount’ where the employee undertakes a business journey in their own car. The approved amount for the tax year is found by multiplying the number of business miles driven by the employee in their own vehicle in that year by the approved mileage rate for that particular vehicle. The approved mileage rates are set out in the following table:

PAGE 4 PAGE 6 Vehicle Cars and Vans Motor cycles Bicycles Approved mileage rate First 10,000 business miles in the tax year: 45p per mile Each subsequent business mile: 25p per mile 24p per mile 20p per mile So, if an employee drives 12,000 business miles in the tax year in their own car, the approved amount is £5,000 ((10,000 miles @ 45p per mile) + (2,000 miles @ 25p per mile). If the employer pays mileage at a higher rate, the excess over the approved amount is taxable, and must either be taxed through the payroll or reported to HMRC on the employee’s P11D. If the employer pays less than the approved amount (or does not pay an allowance), the employee can claim tax relief for the difference between the approved amount and the amount that they receive, if any. The employer can also pay the employee a tax-free passenger rate of 5p per mile for each passenger for whom the journey is also a business journey. However, there is no tax relief available if the employer does not pay passenger payments, or pays them at a rate of less than 5p per mile. For National Insurance purposes, similar rules apply, except that the calculation is performed for each pay period. For cars and vans, an ‘approved’ rate of 45p per mile is used for all business mileage, even if this exceeds 10,000 miles in the tax year. If the amount paid in the pay period is more than the ‘approved’ amount, the excess is included in gross pay. National Insurance purposes only. Company cars If the employee has a company car and the employer does not pay for the fuel, a different set of mileage rates – the advisory fuel rates – apply to determine the amount that can be paid tax-free. These are lower than the AMAP rates, which include an element to reflect the running costs and the depreciation of the employee’s own car. The advisory rates are set quarterly. The rates applying from 1 June 2021 are as follows: Engine size 1400cc or less 1401cc to 2000cc Over 2000cc Petrol rate per mile 11p 13p 19p Engine size 1600cc or less 1601cc to 2000cc Over 2000cc LGP rate per mile 8p 9p 14p Diesel rate per mile 9p 11p 13p Payments of 4p per mile can be made for business travel in an electric company car. Any amounts paid in excess of the advisory rate are taxable and liable to Class 1 National Insurance. If the employer pays for all fuel, including that for private journeys, a fuel benefit tax charge will arise unless the car is an electric car.

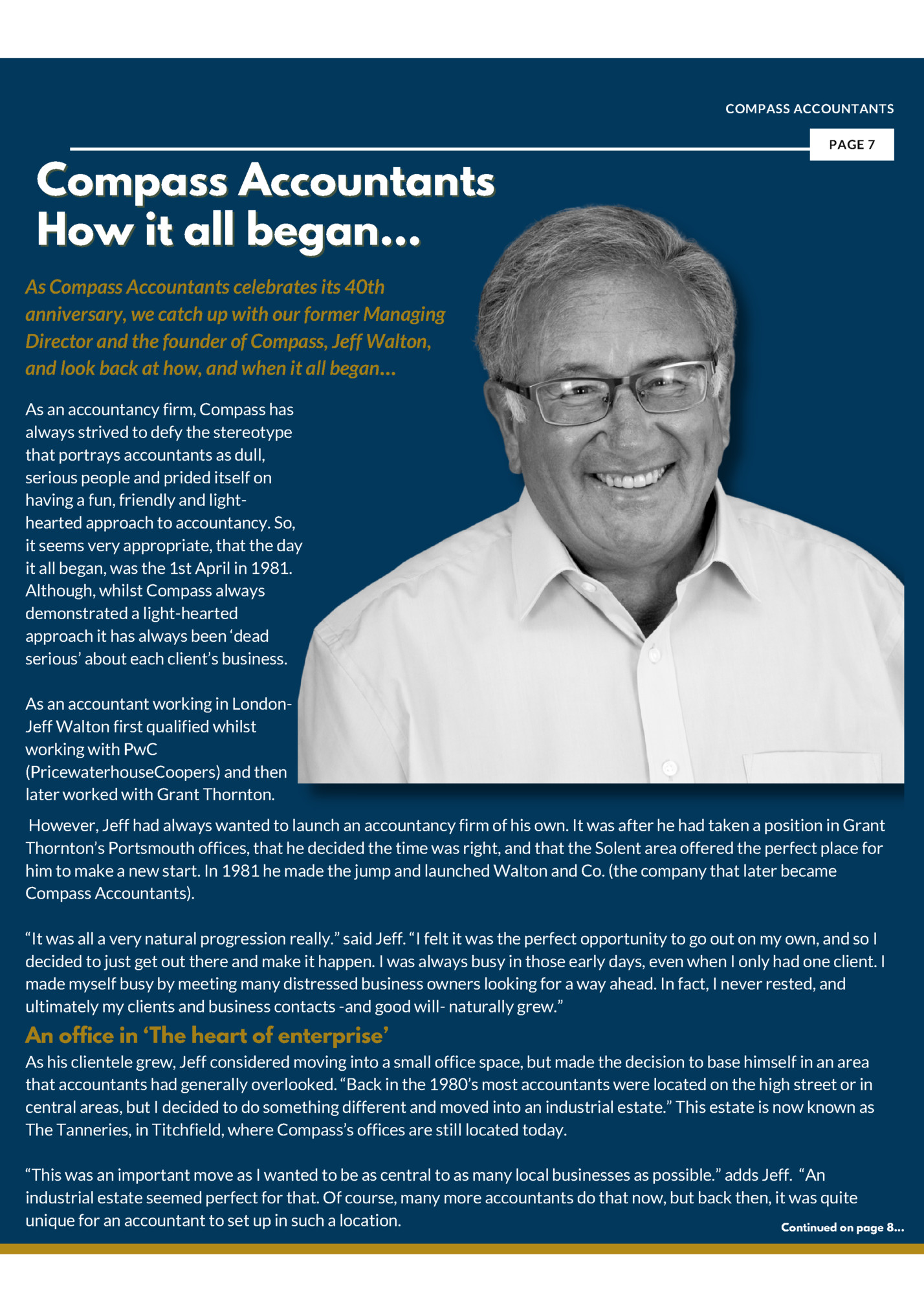

PAGE 7 Compass Accountants How it all began… As Compass Accountants celebrates its 40th anniversary, we catch up with our former Managing Director and the founder of Compass, Jeff Walton, and look back at how, and when it all began… As an accountancy firm, Compass has always strived to defy the stereotype that portrays accountants as dull, serious people and prided itself on having a fun, friendly and lighthearted approach to accountancy. So, it seems very appropriate, that the day it all began, was the 1st April in 1981. Although, whilst Compass always demonstrated a light-hearted approach it has always been ‘dead serious’ about each client’s business. As an accountant working in LondonJeff Walton first qualified whilst working with PwC (PricewaterhouseCoopers) and then later worked with Grant Thornton. However, Jeff had always wanted to launch an accountancy firm of his own. It was after he had taken a position in Grant Thornton’s Portsmouth offices, that he decided the time was right, and that the Solent area offered the perfect place for him to make a new start. In 1981 he made the jump and launched Walton and Co. (the company that later became Compass Accountants). “It was all a very natural progression really.” said Jeff. “I felt it was the perfect opportunity to go out on my own, and so I decided to just get out there and make it happen. I was always busy in those early days, even when I only had one client. I made myself busy by meeting many distressed business owners looking for a way ahead. In fact, I never rested, and ultimately my clients and business contacts -and good will- naturally grew.” An office in ‘The heart of enterprise’ As his clientele grew, Jeff considered moving into a small office space, but made the decision to base himself in an area that accountants had generally overlooked. “Back in the 1980’s most accountants were located on the high street or in central areas, but I decided to do something different and moved into an industrial estate.” This estate is now known as The Tanneries, in Titchfield, where Compass’s offices are still located today. “This was an important move as I wanted to be as central to as many local businesses as possible.” adds Jeff. “An industrial estate seemed perfect for that. Of course, many more accountants do that now, but back then, it was quite unique for an accountant to set up in such a location. Continued on page 8...

PAGE 8 By doing so, I got to know the surrounding companies, and naturally because of our accessibility, our clientele grew. You could say that choosing our location gave birth to one of the Compass’s first straplines - ‘At the heart of enterprise’“ Taking on staff and gradually growing, Jeff rented more and more office space in The Tanneries, and by 1986, the business had occupied the whole top floor of the offices, and later took further space on the ground floor. Business in The 1980’s When Jeff launched the company in 1981, the UK had already entered a recession, with rising unemployment and interest rates, and less funding available from banks. “After working for larger organisations, I really wanted to do things that were a little more positive and to be able to help organisations directly.” said Jeff. “The 1980s were a perfect time to be able to provide that- as so many needed help! Banks were not at all sympathetic and businesses generally wanted access to more money, which they weren’t receiving from their bankers. So, we helped many business owners to reassess, pull everything right back and then to gradually grow again. This process later became known as ‘re-engineering.’” “It was an extremely turbulent time. Lots of business owners were really on their knees. It was a question of offering them positive, useful advice and guidance, and to help them to improve the way they did business, whilst also helping them to regain confidence in themselves.” “If we helped a client that was in trouble, they then introduced us to another company and consequently, we grew and grew. I think one of the main reasons for that was because we thought differently to other people in the profession and were evidently making a difference.” This offering moulded Compass’ general business approach, and paved the way for the brand and its ethos, as well as helping Jeff pen the Compass’ strapline - ‘Helping you to shape your future... not just accounting for your past… “Accountants traditionally positioned themselves as bean counters, providing business owners with historic accounts.” Adds Jeff, “What better way to position Compass than to help a business address its future?” Compass’s People- The secret of success Like most businesses Compass has always understood that its best asset is its people, and its high level of staff retention is testament to that. “We have had so many wonderful people work for us, all of which have played a part in our journey.” Jeff adds. “So many of our staff members, like Sam, Sarah and Stuart, all joined us directly from college, or in Sam’s case, school, and they have only ever worked for us. Stuart, now Compass’ longest serving staff member, has been with Compass for over 34 years joining us in 1987. There is something quite amazing about that. The key for us has always been about identifying that special spark in someone, then fostering that, by giving them the right opportunities to grow within the firm.” In 2004 David Lewis and Greg Harmer, both highly respected and well-known senior accountants, joined Compass as Directors, which gave the company a new structure. “Their arrival brought us a lot more strength at a senior level,” said Jeff, “Which took the pressure off of me, and also paved the way for Stuart and Kerry to take over the company.” Continued on page 9...

PAGE 9 Stuart and Kerry Lawrance became Directors and owners of Compass in 2015, and Jeff retired in 2018. Having met at Compass, the couple were married shortly after becoming Directors of the firm. “Stuart and Kerry- were great acquisitions for Compass and perfect people to take over the business. They had already helped with the overall development of the company- and so when I retired, it felt natural for them to take over. They embodied what we were always trying to achieve. Now, Stuart and Kerry have taken things to a higher level, and it’s great to see that. It is very satisfying to see the business grow in so many ways, to move forward with the times, but still maintain the same ethos and values we started with.” “Whilst I was responsible for the foundations of Compass, it has also been the people around me that have contributed to its success. They helped me to develop the key values of the business and to feed those down into how we operate and the service we offer.” “When I look back proudly at Compass, and how it has evolved over time, I don’t think of it as something I did- but something we did. It is a result of the hard work and dedication of the people and personalities involved with the company over 40 years. It’s wonderful that the foundations still stand strong, as Stuart and Kerry will now lead it into a whole new era.” Stuart and Kerry Lawrance, become owners of Compass in 2015

Fleepit Digital © 2021