Buying Guide C: (705) 872-7483 Julian McCaslin REALTOR® O: (705) 243-9000 Jmccaslin@cbelectricrealty.ca Julianmccaslin.ca

Buying a home is one of the most exciting and sometimes overwhelming decisions you'll make. This guide is here to help you understand the process, answer common questions, and give you a clear picture of what to expect. Whether you're just starting to explore your options or getting serious about your search, this resource is designed to give you the confidence to take the next step.

Buying a home is more than just scrolling through listings and booking showings. A REALTOR® is your trusted advisor, advocate, and expert throughout the entire process. From the first viewing to the final closing signature. Here’s How a REALTOR® Helps You Guidance From Start to Finish Explains the buying process clearly Helps you understand market conditions, pricing, and timing Connects you with trusted professionals (mortgage brokers, lawyers, inspectors, etc.) Access to Listings Provides access to homes not always visible to the public Sets up custom searches to match your specific needs and wants Coordinates and schedules showings for your convenience Expert Property Evaluation Helps assess the value of a home Identifies red flags and helps you make informed decisions Offers insight into neighborhood trends and future resale potential

Advises on pricing strategy and offer conditions Prepares and submits all necessary paperwork Negotiates on your behalf to get the best possible deal Protection & Peace of Mind Ensures your rights and interests are protected Navigates complex legal documents and disclosure requirements Stays by your side through inspections, financing, and closing Working with a REALTOR® means you don’t have to figure everything out on your own. You get experience, local knowledge, and support at every step, at no direct cost to you as a buyer. (In most cases, the seller covers the commission.)

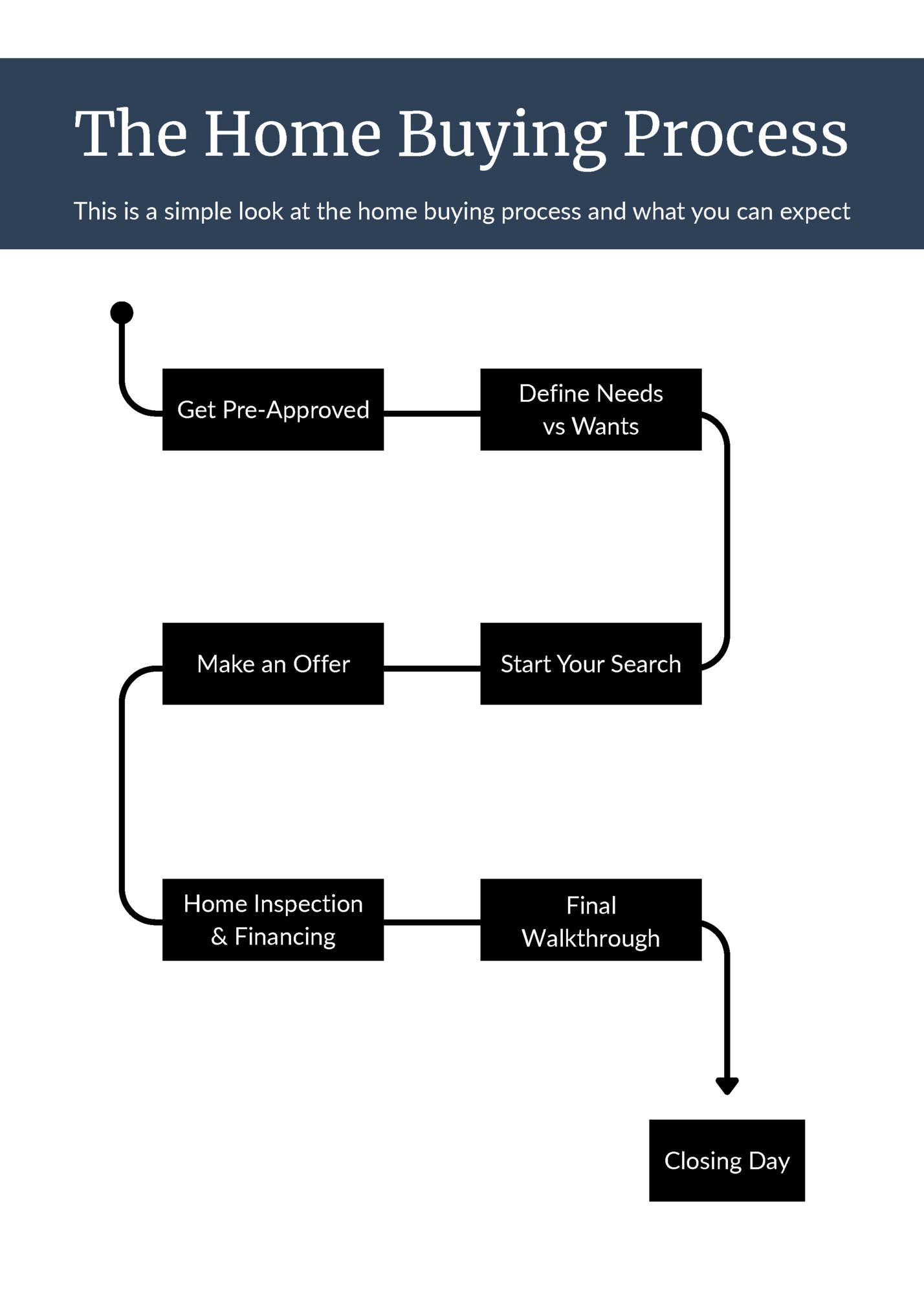

This is a simple look at the home buying process and what you can expect Get Pre-Approved Define Needs vs Wants Make an Offer Start Your Search Home Inspection & Financing Final Walkthrough Closing Day

Everyone says you should get pre-approved but what actually is it? and why is it different from a pre-qualification? Pre-Approval vs Pre-Qualification Pre-Qualification A quick estimate of what you might be able to borrow Based on basic info you provide (income, debt, assets) No formal credit check or documentation required Useful for early-stage planning Pre-Approval A more thorough review by a lender Includes a credit check and verification of your financial documents Results in a written commitment from the lender (subject to conditions) Stronger in the eyes of sellers and shows you're a serious and qualified buyer Tip: A pre-approval carries more weight than a prequalification when submitting an offer on a home. 💡

Use this space to think of your wants vs needs. A want may be a big back yard or a deck, and a need could be 2 bathrooms or a garage. It’s completely up to you. Wants Needs

It’s more than just looking at listings and booking a showing. Setting Up A Search As a Real Estate Agent, I can create a personalized property search tailored to your specific criteria. Once we have that set up, we can explore the listings that catch your interest. Viewing The Property When you are looking at a property you want to look for any issues and make sure it has what you want. Look for stains, mold, mildew, broken floor boards, cracked tiles, etc. Don’t test just look, the home inspector will do tests for you. Look At The Area Look at the neighborhood, are the houses maintained? Are the houses better or worse? Are you close to things you need, transportation, shopping area’s, schools, highway’s.

What goes into your offer, and what should you be prepared for? What Goes Into Your Offer? In your offer you will want the Purchase Price, Deposit Amount, Irrevocability Time, Closing Day, Title Search Day, and Conditions Purchase Price - The price you are willing to pay for the property. (This is not always the highest price you would pay) Deposit Amount - This is how much you are offering the seller if they accept your offer. This amount comes off the total price of the house. This is not your down payment, and it’s not required but it does improve your offer. Irrevocability Time - This is how long the other party has to accept your offer, once you submit it there is no taking it back. If they don’t accept that offer it becomes null and void. Title Search Day - This is the last day your lawyer will have to make sure everything on the title is clean, no liens, no work orders, etc. Closing Day - This is the day everything comes together, money gets moved, the title gets transferred, and the keys get handed over. Conditions - Conditions are put in when a party wants something, or wants something to happen before they commit to the sale being firm. This could be a home inspection for the buyer, or a sellers accommodations clause for the seller.

Fleepit Digital © 2021