Agenda for meeting due on Thursday 20 February 2025 The Atrium, St George’s Street, Norwich at 10.30am 1. Declaration of interests 2. Apologies 3. Approve minutes of the meeting held on 3 October 2024, consider draft minutes of AGM held on 3 October 2024, and matters arising (not covered on the agenda) 4. Confirm dates of 2025 meetings 5. Consider Stockbroker’s report and recommendations 6. Clerk’s report on Investment Property 7. Projected management accounts for the year ending 31 March 2026 8. Consider level of grants to descendants and parental income limits for year ended 31 March 2025: (a) Discuss criteria relevant to grants to descendants (b) Level of grants to descendants (c) Parental income levels 9. Consider management accounts for year ended 31 March 2025 10. Grants to other bodies 11. Claimants Unity update – David Nobbs 12. Trustee visit(s) 13. Any other business (a) Exhibition at Norfolk Records Office Documents: Minutes of Trustee meeting from 3 October 2024 Draft AGM minutes Barratt & Cooke Report Clerk’s report on investment property (to follow) Management accounts 2024/25 and 2025/26 Descendant grants levels and parental income limits Applications from other bodies

Minutes of a meeting of the Trustees held in The Atrium, St George’s Street, Norwich on Thursday 3 October 2024 PRESENT: Action Chris Brown(CB)-Chair, David Nobbs(DN), Julia Leach(JL), Roy Hughes(RH), Philip Butcher(PB), Tracey Hughes(TH), Francis Whymark(FW), Nick Saffell(NS)-Clerk In Attendance: Peter Harbord(PH), Mary Derbyshire(MD) of Brown & Co 1 Conflict of Interest No conflicts of interest were announced. 2 Apologies Roger Sandall, Andrew Parsons, Tim Lawes 3 Minutes of the meeting held on 6 June 2024 The minutes were approved by the Trustees and duly signed by the Chair. 4 Consider Stockbroker’s report and recommendations The Trustees had looked at the report prior to the meeting, and Mr Barratt, from Barratt & Cooke, had forwarded a message to the Trustees: The portfolio is broadly unchanged since the last meeting - we buttoned down the hatches and managed to negotiate an election relatively unscathed, with little trade there was not much to report. The Trustees agreed that on receipt of the next tranche of money, from the sale of land, that it should be added to the same gilt as it was from the first lot of money. 5 Review of Risk Management policy NS said there had been no change to the policy, but that in the draft risk register, on the mention of COVID, NS had lowered the risk. RH mentioned that there may be a risk concerning the possible land purchase. This matter will be considered. 6 Review of Reserves Policy The policy was agreed as acceptable for the current time by the Trustees. 7 Clerk’s report on Investment Property The Clerk’s report had been circulated with the agenda for today’s meeting. NS confirmed the dates for receipt of the tranches from the sale of land. The next payment due in December 2024 in the sum of £422,000. On the matter of anti-social behaviour on the flat roof at Nelson Place Shopping Centre, FW recommended that contact is made with Breckland Council as they have a team who may be able to help with this. 8 To consider revised budget for the year ending 31 March 2025 The budget had been circulated with this meeting’s agenda. However, Mr Harbord had updated some of the figures with the latest information being provided from Barratt & Cooke. The agricultural rental from income had come down, but this had been expected due to the land sale. There will be around £284,000 for distribution with £98,000 for descendants. 9 To confirm grants made to descendants for the year ended 31 March 2024 (list 1) The Trustees noted the grants that had been made. 10 To confirm grants to descendants for year ended 31 March 2025 (list 2, 3 and 4) Grants to descendants were looked at and agreed where appropriate. A sub-committee will look at the application forms and consider the cost of utilities when calculating parental income. This meeting will be held in February 2025.

Applications Mr Harbord presented the Trustees a descendant request for funding towards an open university course. It was agreed to support the £900 request. A further funding request had been received from a descendant whose salary had increased (due to the minimum wage). It was though agreed to provide funding for materials in the sum of £500. Mr Harbord had received an application from a descendant mother whose young daughter had been diagnosed with epilepsy. The mother had moved the daughter to a school that she felt had more appropriate care to offer but the school was outside the area of provision for free school transport. The bus pass was costing the family £65 per month. The Trustees agreed to provide a grant in the sum of £500 towards the transport costs, but to let the family know that this funding may not be available every year. 12 Grant applications from individuals (non-descendant) and other organisations WHITE WOMAN LANE SCHOOL/OLD CATTON CofE JUNIOR SCHOOL – CB mentioned that he had been informed by the Head of both schools that funding for special educational needs has been cut. It was agreed to donate £7,980 to cover the cost provided by The Grounded Forest to each school. Agreed: £15,960 TOYLIKEME – this charity brings together, and supports, deaf parents and deaf children. It was agreed to donate towards the Little Bear Club project, a group for deaf pre-schoolers (birth-5 years old) in Norfolk. Agreed: £5,000 EACH – the Trustees approved the request for funding towards music therapy. Agreed: £2,500 FROZEN LIGHT – supporting children with profound and multiple learning disabilities to gain confidence in performing. Agreed: £3,000 ELSA HILL – to represent Norfolk in a week-long girl guiding internation opportunity. Agreed: £500 NORFOLK WILDLIFE TRUST – Wilder Schools programme. Agreed: £2,000 THE CREATIVE CARERS AND MIGHTY OAKS – supporting young carers. PH will contact the applicant to request where any donation of funds would be spent. Deferred COMMUNITY SAFETY EDUCATION – funding towards the Money Wise financial literacy programme. The Trustees agreed that the two schools are situated in the Norman area, and where there is major deprivation. Agreed: £2,200 NANSA – approved CAST – the Trustees felt it was good to encourage education. 13 Agreed: £2,500 Agreed: £1,500 Alderman Norman Claimants’ Unity – update from David Nobbs(DN) - DN reported that the Unity may have to disband as from the AGM next April. - There will no longer be a carol service or bible service. - It was agreed that the Trustees will now be responsible for the distribution of bibles to descendants. - The registrar will continue the current role. It was agreed to increase the Registrar’s Honorarium, as well as the Deputy Registrar’s, by 2%. 14 Any other business (a) Exhibition at Norfolk Records Office This had been a success and enjoyed by all attendees.

A further date will be issued for a date to rearrange a visit. (c) The annual Norman dinner will be held on Thursday 16 January – an opportunity to thank Nick prior to his retirement from the Charity in March 2025. A new clerk will be appointed from within Brown & Co, who will meet the Chairperson in due course. (d) Dates of 2025 meetings: Thursday 20 February – 10.30am Thursday 5 June – 10.30am Thursday 2 October – 10am (to include the AGM at the earlier time) The meeting closed at 12noon.

Minutes of the Annual General Meeting (AGM) held from The Atrium, St George’s Street, Norwich on Thursday 3 October 2024 at 10am Present: Chris Brown(CB)-Chairman, David Nobbs(DN), Julia Leach(JL), Roy Hughes(RH), Philip Butcher(PB), Tracey Hughes (TH), Francis Whymark(FW), and Nick Saffell(NS)-Clerk In attendance: Stewart Halton of Argents Chartered Accountants, Peter Harbord, Mary Derbyshire of Brown & Co 1 Trustees’ Interests No interests were declared. 2 Apologies Mr R Sandall, Rev A Parsons, Mr T Lawes 3 To confirm the minutes of the AGM held on 7 December 2023 These were agreed to be a true record of the meeting held last year. Typing errors were corrected, after which the minutes were signed by the Chairman. 4 action To consider and approve the draft Annual Accounts to 31 March 2024 Stewart Halton, from Argents Chartered Accountants was welcomed by the Chairman. Mr Halton went through the draft accounts, copies of which were distributed to the Trustees. The following comments were noted: - From the balance sheet on page 8, the property value was down due to land sale at Catton - The debtor figure is slightly higher - The investment figure, as detailed in Barratt & Cooke’s report, is the market value as per the portfolio, but does not include any cash held - Figures will still show to be in debt next year, but will go down as the money comes in - In the statement of financial activity, on page 7, the accounts are broadly as expected. Note 20 provides additional information about income - The overall performance, year on year, is similar - The Chairman and the Clerk will look over the report to confirm any changes - Last year’s references to figures to be updated (a) The draft accounts and the draft Trustees’ report for the year ended 31 March 2024 will be looked at by the Chairman and the Clerk for approval. (b) It was agreed that the Chairman and the Clerk will sign the Accounts and Report, once the updates have been included, on behalf of the Trustees. (c) It was agreed that one Trustee and the Clerk sign the Letter of Representation to Argents. (d) It was agreed that the Clerk submit the Annual Accounts and Annual Report to the Charity Commission before the due date. (e) It was agreed that the Clerk completes the Charity Commission’s Annual Return for the Charity before the due date. 5 5.1 CB/NFS CB/NFS NFS NFS Any Other Business On consideration of the use of the money from the sale of the land in Catton, the Clerk stated that he had found a parcel of land within the boundary of Norwich. The land is surround by houses, it is 65 acres, and to be used as farmland. It was mentioned that this would be a speculative investment and therefore the Trustees should be aware of the risks. To purchase the land, the Charity would offer to pay in tranches and therefore over the period of time that the funds come in from the Catton land sale. The Trustees asked for further confirmation and details from the Clerk prior to any final commitment. 5.2 The Chairman will ask a tax assistant to look at the cash holding. 6 Date of next meeting(s) Thursday 20 February – 10.30am Thursday 5 June – 10.30am Thursday 2 October – 10am (to include the AGM at the earlier time) The meeting concluded at 10.30am. NFS

n.saffell@brown-co.com Re: BROWN & CO A/C TRS ALDERMAN NORMAN FDN CAPITAL ACCOUNT Our ref: WJB/HDL/C004689 10th February 2025 Dear Nick, Alderman Norman Foundation Ahead of the trustees meeting on 20th February 2025, I attach an up-to-date valuation showing: Value 04/02/2025 Income Yield on Investments £6,904,255 £174,160 2.5% The current asset allocation is: 32.0% 3.5% 35.5% Government Gilts Bonds Total Fixed Interest 42.5% 6.1% 12.2% 60.8% Equities Investment/Unit Trusts COIF Total Equity 2.9% 0.8% 100% Alternative Assets (Private Equity and Infrastructure Funds) Cash The performance since the last report has been: 23/09/2024 04/02/2025 Performance Portfolio £6,236,608 £6,904,255 -0.6%* FTSE 100 8260 8571 +3.8% PIMFA Balanced 1898 1987 +4.7%

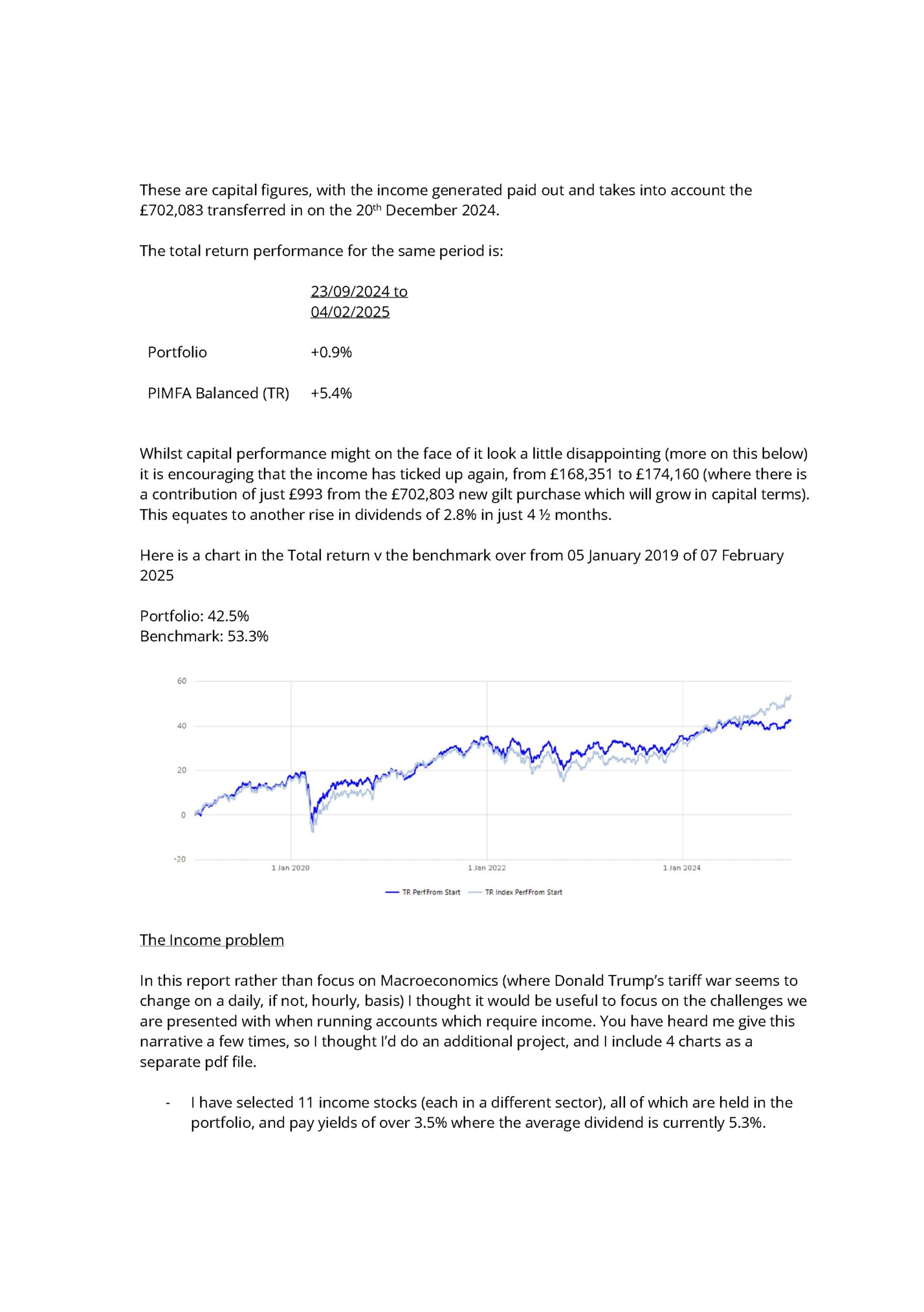

£702,083 transferred in on the 20th December 2024. The total return performance for the same period is: 23/09/2024 to 04/02/2025 Portfolio +0.9% PIMFA Balanced (TR) +5.4% Whilst capital performance might on the face of it look a little disappointing (more on this below) it is encouraging that the income has ticked up again, from £168,351 to £174,160 (where there is a contribution of just £993 from the £702,803 new gilt purchase which will grow in capital terms). This equates to another rise in dividends of 2.8% in just 4 ½ months. Here is a chart in the Total return v the benchmark over from 05 January 2019 of 07 February 2025 Portfolio: 42.5% Benchmark: 53.3% The Income problem In this report rather than focus on Macroeconomics (where Donald Trump’s tariff war seems to change on a daily, if not, hourly, basis) I thought it would be useful to focus on the challenges we are presented with when running accounts which require income. You have heard me give this narrative a few times, so I thought I’d do an additional project, and I include 4 charts as a separate pdf file. - I have selected 11 income stocks (each in a different sector), all of which are held in the portfolio, and pay yields of over 3.5% where the average dividend is currently 5.3%.

I have selected 10 Growth stocks (similarly spread across an array of sectors) each of which pays a yield of under 2.0% and where the average dividend is currently 1.1%. We have plotted charts of each of these holdings from the 1st Jan 2020, to date (7th February 2025). This takes into consideration both significant market ‘slumps’ (i.e. COVID-19, and the war in Ukraine with an associated energy crisis) as well as periods of recovery (the lifting of lockdown and Magnificent 7 rally). In the below calculations, it is deemed that each position is held in equal weight and that they have been held from the start (they have not all been held from 2020 but this is an illustration to show direction of travel rather than portfolio specifics). Chart 1 –The share price return of the income stocks over this period. £100 would now be worth £99.56. Chart 2 - The share price return of the growth stocks over this period. £100 would now be worth £209.75. Chart 3 - The total return (share price + dividend) of the income stocks over this period. £100 has returned £128.97 in total. Chart 4 -The total return (share price + dividend) of the growth stocks over this period. £100 has retuned £221.46 in total. Observations: - - - - - The extent to which holding income stocks in portfolios has created drag on performance is both unprecedented and extraordinary since January 2020. The income portfolio has actually marginally lost value in share price terms over the period, though of course, after accounting for income, (which is lost from the valuation bottom line) it is ahead by £28.97 per £100. The benchmark PIMFA Balanced index has an increasing bias towards the growth stocks as it is driven on a market capitalisation basis, furthermore as the share prices go up the replacement yield falls further. The yield derived from the PIMFA benchmark is just 2.8%, your portfolio (if we strip out the £1.4m gilt bought simply for growth) pays an income on current prices of 3.2% and, on cost of the underlying holdings, 4.9%. Of course the objective of the charity is to distribute income to worthy causes and therefore we strive to continue to grow the yield, I am however very glad we take the income ‘hit’ in certain cases to try and keep growth up too. It is also worthwhile noting that at the moment we are in a ‘bull run’, markets have performed strongly recently however for example, in the Ukraine crisis ‘slump’ the income stocks did display greater resilience, so in general the portfolio is well served by these holdings in falling markets. It is also important to remember that some of the income holdings were once growth stocks, i.e. the likes of Reckitt Benckiser, Rio Tinto, Shell and National Grid all stand on good historic gains, the majority of these profits were materialised before the chart starts. Furthermore, we do sometimes top slice profits (Novo Nordisk in July 2022 and May 2023).

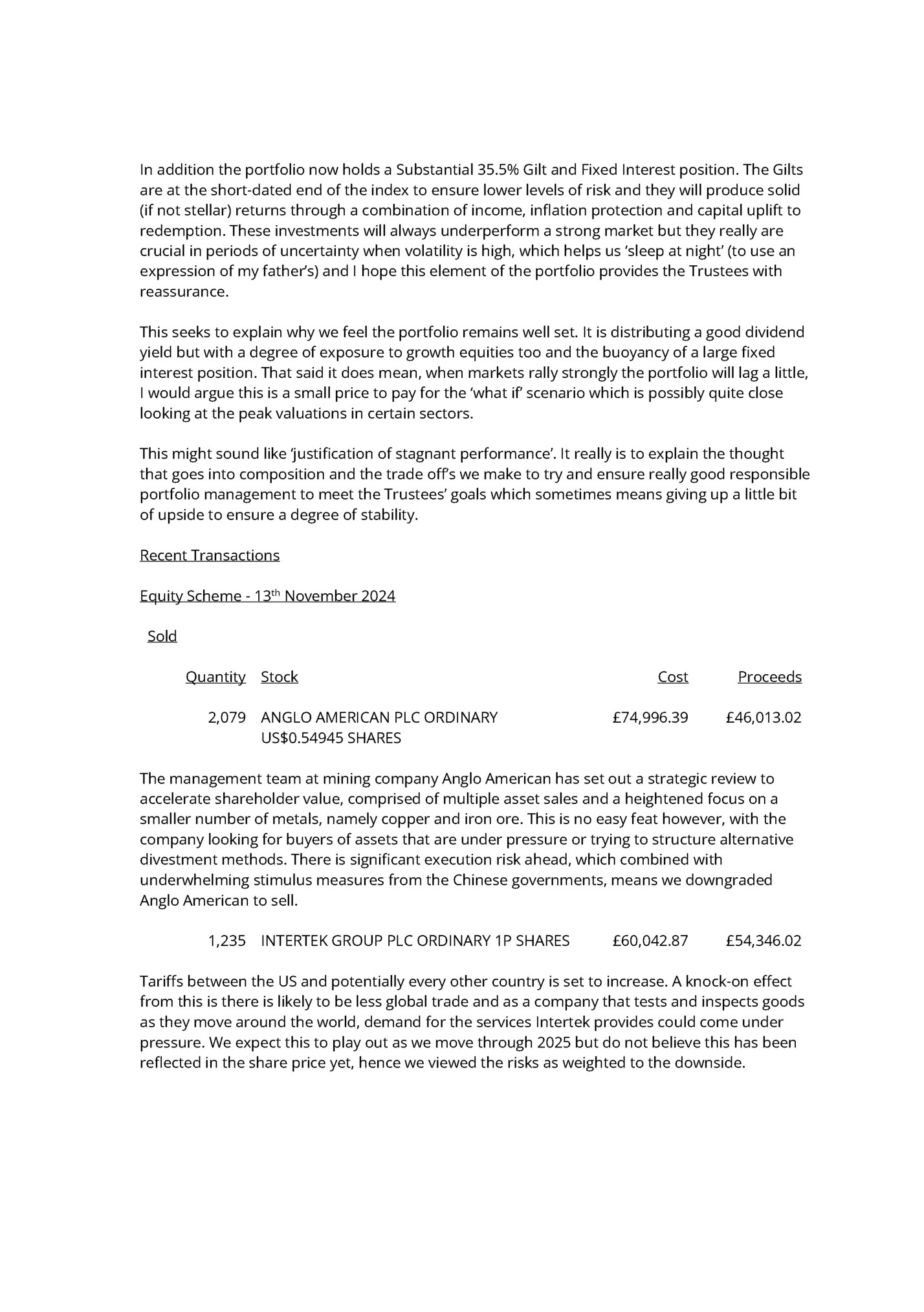

are at the short-dated end of the index to ensure lower levels of risk and they will produce solid (if not stellar) returns through a combination of income, inflation protection and capital uplift to redemption. These investments will always underperform a strong market but they really are crucial in periods of uncertainty when volatility is high, which helps us ‘sleep at night’ (to use an expression of my father’s) and I hope this element of the portfolio provides the Trustees with reassurance. This seeks to explain why we feel the portfolio remains well set. It is distributing a good dividend yield but with a degree of exposure to growth equities too and the buoyancy of a large fixed interest position. That said it does mean, when markets rally strongly the portfolio will lag a little, I would argue this is a small price to pay for the ‘what if’ scenario which is possibly quite close looking at the peak valuations in certain sectors. This might sound like ‘justification of stagnant performance’. It really is to explain the thought that goes into composition and the trade off’s we make to try and ensure really good responsible portfolio management to meet the Trustees’ goals which sometimes means giving up a little bit of upside to ensure a degree of stability. Recent Transactions Equity Scheme - 13th November 2024 Sold Quantity 2,079 Stock ANGLO AMERICAN PLC ORDINARY US$0.54945 SHARES Cost Proceeds £74,996.39 £46,013.02 The management team at mining company Anglo American has set out a strategic review to accelerate shareholder value, comprised of multiple asset sales and a heightened focus on a smaller number of metals, namely copper and iron ore. This is no easy feat however, with the company looking for buyers of assets that are under pressure or trying to structure alternative divestment methods. There is significant execution risk ahead, which combined with underwhelming stimulus measures from the Chinese governments, means we downgraded Anglo American to sell. 1,235 INTERTEK GROUP PLC ORDINARY 1P SHARES £60,042.87 £54,346.02 Tariffs between the US and potentially every other country is set to increase. A knock-on effect from this is there is likely to be less global trade and as a company that tests and inspects goods as they move around the world, demand for the services Intertek provides could come under pressure. We expect this to play out as we move through 2025 but do not believe this has been reflected in the share price yet, hence we viewed the risks as weighted to the downside.

Fleepit Digital © 2021