FOR SME OWNERS YOUR STEP-BY-STEP GUIDE TO FILING TAXES ONLINE. PREPARED BY: BS ACCOUNTANCY STUDENTS OFJILCF

E-TAX? Photo Courtesy: https://una-acctg.com Switching to e-tax is a practical step for small business owners because it makes tax filing faster, easier, and more reliable compared to manual processes. Through the Bureau of Internal Revenue’s (BIR) eBIRForms system, business owners can file returns anytime and anywhere, without the need to wait in long lines or deal with excessive paperwork. This saves valuable time that can instead be spent on running the business. E-tax also provides instant confirmation of submissions, reducing the risk of misplaced documents and ensuring peace of mind. By adopting digital tax filing, SME owners not only stay compliant with government requirements but also save money, effort, and stress in the long run.

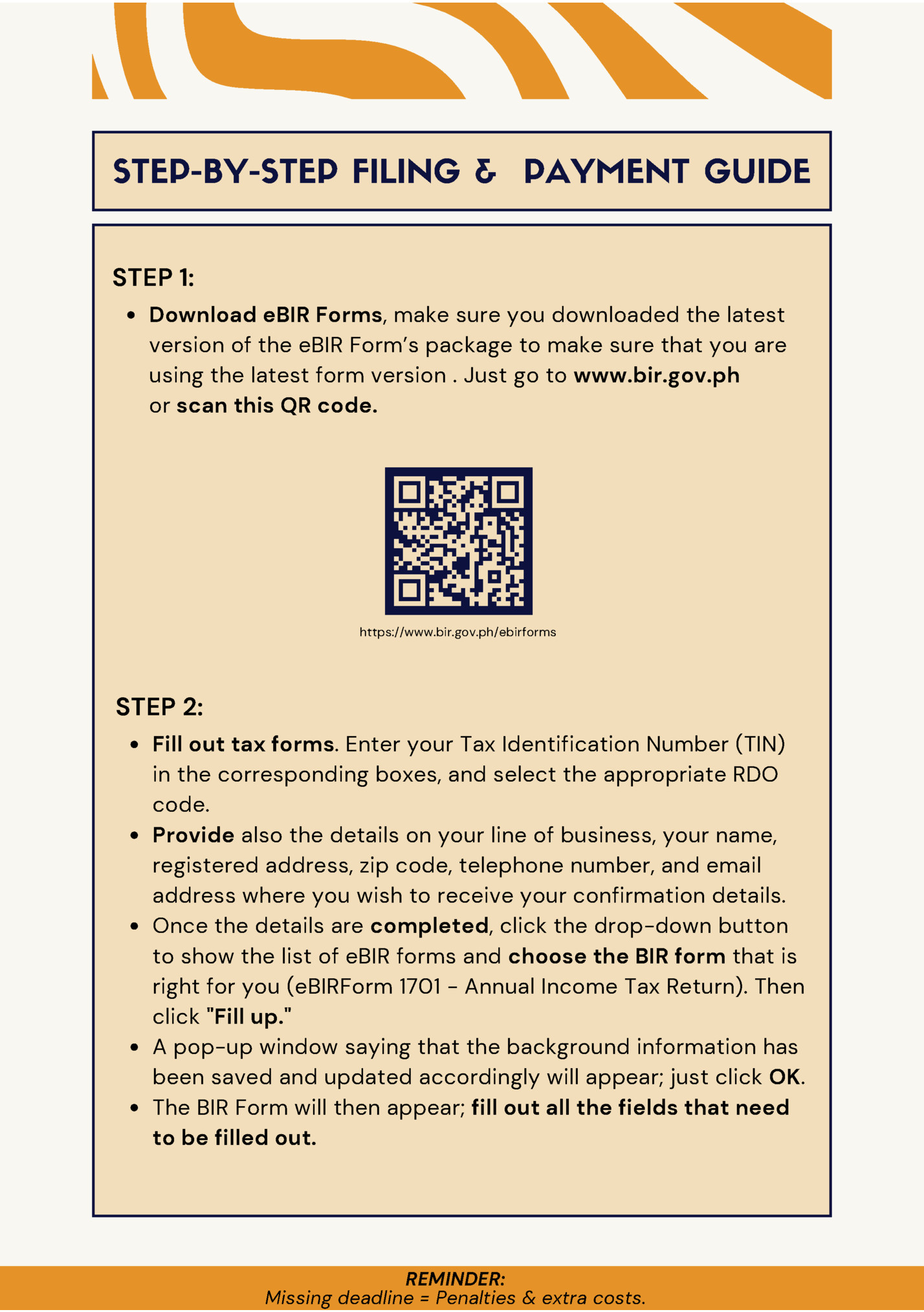

STEP 1: Download eBIR Forms, make sure you downloaded the latest version of the eBIR Form’s package to make sure that you are using the latest form version . Just go to www.bir.gov.ph or scan this QR code. https://www.bir.gov.ph/ebirforms STEP 2: Fill out tax forms. Enter your Tax Identification Number (TIN) in the corresponding boxes, and select the appropriate RDO code. Provide also the details on your line of business, your name, registered address, zip code, telephone number, and email address where you wish to receive your confirmation details. Once the details are completed, click the drop-down button to show the list of eBIR forms and choose the BIR form that is right for you (eBIRForm 1701 - Annual Income Tax Return). Then click "Fill up." A pop-up window saying that the background information has been saved and updated accordingly will appear; just click OK. The BIR Form will then appear; fill out all the fields that need to be filled out. REMINDER: Missing deadline = Penalties & extra costs.

STEP 3: Scroll down and click "Validate" to see if you have completely filled out the form. This will tell you if there's a field that you have missed. If you've completely filled out the form, you'll see a pop-up window confirming that the form has been successfully validated. Just click OK. Then you can submit the form. But before you do that, you have the option to save and print the form. STEP 4: Once you're good, click the "Submit/Final Copy" button. A pop-up window will appear to remind you to have a stable internet connection and a valid email address; click OK. The eBIR forms terms of service agreement window will then appear; click OK. The form will submit, and it may take several seconds depending on your connection speed and traffic. Once it has been successfully submitted, a pop-up window will then appear. It's best that you save a screenshot of that page to serve as proof that you have successfully submitted the form, just in case you fail to receive the email confirmation from the BIR. Once done, click OK. STEP 5: Proceed to payment. There are several payment options through eFPS. You can use a bank debit account, which you can link to your enrolled bank like Landbank, BPI, or Metro Bank. Another option that's suitable for a small business owner/small taxpayer like you is the GCash or Maya. Make sure to pay on or before the deadline to avoid interest and penalties. REMINDER: Missing deadline = Penalties & extra costs.

Be organized. Keep both digital and paper copies of your receipts, invoices, and sales records. Use folders that is labeled by month in your computer or cloud storage (e.g., Google Drive, OneDrive). Regularly update your records, instead of waiting until deadlines. Use the technology. Your phone can be your “tax assistant.” Use free apps like Google Calendar, or even built-in reminders to track filing schedules. Use your phone’s camera to scan receipts and save them in a dedicated tax folder. Learn in small steps. Don’t try to master everything in one sitting. Watch short tutorials, practice filling out one form at a time, and gradually build confidence. Start with basic forms like 2551Q (Percentage Tax) before tackling annual income tax forms. Balance business and learning. Assign a trusted family member or staff to take care of your shop while you attend training. If you can’t leave, use recorded tutorials that you can replay during free time (even after business hours). Don’t be afraid to ask for help. Join community training, barangay help desks, or ask fellow SME owners who already file online. The BIR also has hotlines, and some LGUs set up Tax Assistance Desks during peak months.

(FAQS) What is e-tax filing? E-tax filing is the process of submitting your tax returns electronically using the BIR’s eBIRForms system instead of manually submitting paper forms at the RDO (Revenue District Office). It is faster, more convenient, and provides instant confirmation once filed. Who is required to use eBIRForms? Most taxpayers, especially: Self-employed individuals (sole proprietors, freelancers, professionals) SMEs registered with BIR Optional: Others who want faster processing What do I need before filing online? Valid Taxpayer Identification Number (TIN) Registered email address (linked to BIR) A computer or laptop with internet connection Installed eBIRForms package (downloadable from BIR website) Your updated sales/expenses records eBIRForms → → https://www.bir.gov.ph/ebirforms What are the common tax forms SMEs need? BIR Form 1701Q – Quarterly Income Tax Return BIR Form 1701/1701A – Annual Income Tax Return BIR Form 2551Q – Quarterly Percentage Tax → How do I download eBIRForms? Go to www.bir.gov.ph eServices Or you can scan here: Download.

(FAQS) What happens if I make a mistake in the form? You can file an amended return through eBIRForms. Just select “Amended Return” in the form and resubmit. Always keep copies of both the original and amended returns. How will I know if my filing is successful? You will receive a confirmation email from BIR containing the details of your submission. Save or print this email as proof. Do I still need to pay taxes at the bank after filing online? Yes, filing is only one step. If you have tax dues, you must pay through: Accredited banks of the BIR Online payment channels (GCash & PayMaya) What penalties will I face if I miss the deadline? Late filing leads to: 25% surcharge on tax due 20% interest per year on unpaid tax Compromise penalty depending on the tax type. Criminal penalties as failure to file and/or pay taxes or for fraudulent returns. So filing early is the best way to avoid these. What if I don’t earn income for the quarter? Do I still need to file? Yes. SMEs must file a “No Income Tax Return” or “Zero Filing” for that period. Non-filing can still result in penalties even if you had no sales or income. How do I secure my tax records? Save files in at least two places (USB + Cloud Storage). Print copies and keep them in a safe folder. Label by tax year for easier tracking.

BUREAU OF INTERNAL REVENUE E-BIR Website https://www.bir.gov.ph/home BIR Facebook Account https://www.facebook.com/ birgovph BIR Video Tutorial https://www.youtube.com/ @birgovph_rdo25a BIR Tax Reminder https://www.bir.gov.ph/taxreminder LOCAL GOVERNMENT UNIT (BOCAUE) Municipality of BocaueBusiness Office https://www.facebook.com/municipal ityofbocauebusinesspermitandlicensingoffice Bocaue Mayor’s Facebook Account https://www.facebook.com/MayorJon jonJJVVillanueva RESEARCHERS If you have questions, don’t hesitate to message the researchers. Virginia Joi Mendieta Renalyn Sevilla Alliah Cherrylle Angelica Mae Sotto Ventura Marivel Villarojo

deadlines—it’s about building trust, saving time, and empowering businesses to grow.” NEED HELP? LGU/BIR: Bocaue Municipal Office- Brgy. Igulot Bocaue, Bulacan (044) 816 6938 www.bir.gov.ph 🌐 🌐 ☎️ ☎️ 📍 📍 RESEARCHERS: +63 9086678418 sevillarenalyn@jilcf.edu.ph villarojomarivel@jilcf.edu.ph ☎️ ☎️ ✉️ ✉️ “Give to everyone what you owe them: If you owe taxes, pay taxes; if revenue, then revenue; if respect, then respect; if honor, then honor.” Romans 13:7

Fleepit Digital © 2021